How Is Blockchain Securing Transactions In Banking?

How Is Blockchain Securing Transactions In Banking?

Blockchain is the new buzzword in the financial world! Find out what blockchain in banking is and how BFSI is using the new technology to secure its transactions.

The coronavirus pandemic has resulted in a massive influx of services functioning online! Traditional brick-and-mortar institutions like banks are now resorting to the online mode to ensure the health and safety of their beneficiaries.

The financial services industry is now shifting to digital services with conversational banking. It is utilising technologies such as Blockchain and compiling it with Conversational AI Chatbots. This ensures a smoother functioning and a massively better user interface in online banking applications!

Many top banks and financial institutions have already adopted the use of blockchains and AI chatbots, like Erica by Bank of America, Amex Bot by American Express, and EVA by HDFC Bank.

Let’s dig deeper into blockchain technology in financial services, and how conversational AI chatbots with blockchain are revolutionising the BFSI industry.

Security issues faced by the BFSI industry

Elements that can threaten one’s privacy and safety offline also riddle cyberspace. The BFSI sector, in particular, deals with various growing threats such as malware, ransomware, phishing scams and identity thefts. Conventional database management systems might not be able to provide ample protection against these issues.

Blockchain is the best solution in this scenario because of its various security features like cryptographic encryption and the requirement of mutual consensus to alter any data.

A Santander report states that an industry-wide implementation of blockchain will reduce banks’ infrastructure costs due to securities trading, cross-border payment, and regulatory compliance by $20 Billion per annum.

What even is Blockchain?

Blockchains refer to digital databases with no authority or power centralising their functioning. Decentralisation means that the authority of decision-making and supervision lies with a single entity. All the blockchain users have the same powers over the information they access on it.

It is an open ledger that keeps tabs on transactions made between multiple parties. Since distributed ledgers work as a platform of truth and trust because it is not easy to hack them. Furthermore, the tamper-proof structure ensures that all counterparties operate with the knowledge that they are all working with the same structure of the actual financial history.

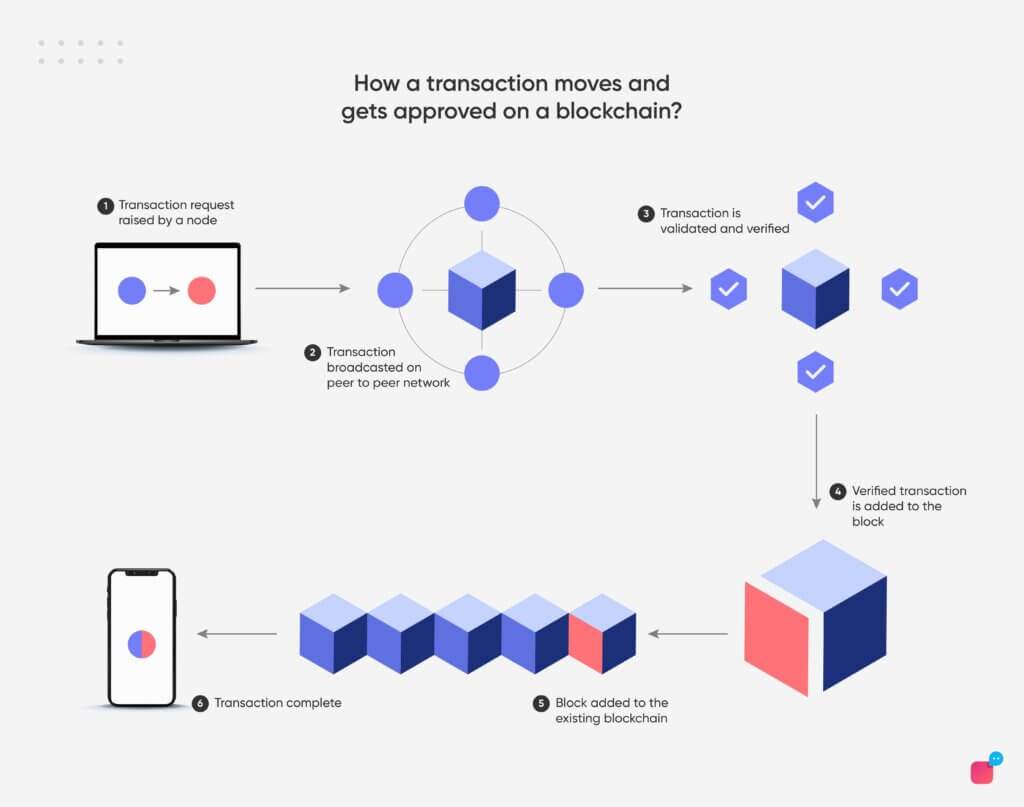

A sequence of transactions in a certain order links the data blocks which constitute the blockchain. Blockchain in payments ensures the quick processing of financial transactions.

Blockchain in banking can guarantee the reliability and security of data in ways that are beyond imagination with traditional security practices. It is emerging as one of the major technological branches in today’s times. Many top financial and business firms have chosen to adopt blockchain to improve trade efficiency.

Also read: Navigate Customer Support For Cryptocurrency Exchanges With Conversational AI

Blockchain in the banking industry: What is its prevalence?

In the BFSI industry, many firms are using this technology to improve B2B payments in developing economies.

Currently, in the clearance systems of financial institutions, it takes 3 days on average to clear out a transfer. Existing protocols like SWIFT merely send the orders for transactions, and the rest of the process happens through intermediaries.

In fact, 60% of B2B transactions are manually done. Blockchain shortens this entire procedure, allowing instant transactions that clear and settle as soon as a payment is made.

For fundraising, companies using blockchain could raise over $4 Billion in 2018 in Initial Coin Offerings or ICOs in lieu of tokens.

Blockchain in banking also facilitates the transaction of securities, like stocks, credit and commodities. It removes the intermediaries in asset rights transfers, reducing the fees of asset exchange. It also reduces the instability of securities markets. Moving securities to blockchain ledgers can help to reduce a whopping 17 Billion USD at minimum from global trade processing costs.

Apart from this, in the financial world, Blockchains are most widely in use these days as a part of various cryptocurrency systems, such as Bitcoin and Ethereum.

Blockchains are used for Non-Fungible Tokens (NFTs), real estate, keeping personal information safe, voting, logistics, administration of welfare programmes, and keeping track of artist royalties.

How does a Blockchain-backed transaction occur through AI chatbots?

Cryptography ensures that the blockchain ledger is completely secure. Every transaction is properly recorded on the blockchain using encrypted, infallible data. Payment will be visible in the ledgers of the bot’s blockchain-backed balance sheet. Thus, you will always have proof, which makes sure you don’t get swindled out of your money.

The reason why chatbots and blockchain can go hand-in-hand is that a chatbot can reduce the long winding procedure of online transactions into smaller steps. An AI bot can directly process your transactions and upload them onto the blockchain database. This reduces having to navigate around multiple authorisations to access your finances.

An example of this can be as follows. Suppose, you wish to transfer some money into your account from another one. The conversational chatbot will assist you by doing this, and provide tailored recommendations for you. It will facilitate access to your banking information, much like an official in a bank would do. Once the transaction is complete, the blockchain will add the details of the transactions into the ledgers. Thus, the combination of the AI chatbot and blockchain streamlines the whole process, making it easy and convenient.

The best part about blockchain is that once the record is entered, it cannot be deleted or tampered with. In case of disputes in the future, the blockchain ledger can easily be accessed to verify the facts of the transactions.

How does blockchain in banking make transactions more secure?

Both blockchain and conversational AI chatbots are becoming increasingly commonplace in the financial sector. Most top banks and BFSI firms have jumped onto the bandwagon and integrated these technologies into their digital platforms.

Now the question arises; instead of linking with a blockchain, why can’t chatbots be used as it is? The answer lies in the security detail.

With blockchain in banking, there is always a consensus mechanism that achieves agreement, trust and security in the decentralised computer network. This means that all the nodes of the blockchain have the exact same single valid copy of the record between them. While everyone can review the blockchain entries, the update of records will only be possible upon the consensus and cooperation of the majority of participants.

Chatbots which haven’t been integrated with blockchain can potentially enable fraudulent practices. Because AI chatbots can appear nearly sentient to most people, they might lower their guard and fall victim to phishing scams.

The more careful customers using an online application, or website, to conduct financial transactions might not be willing to entrust sensitive information to bots. This is especially true when the information is related to financial matters like credit card information, bank account number, etc.

Distributed Ledger Technology

On the other hand, if this chatbot is linked to a blockchain, it maintains a proper ledger of all transaction histories. Not only that, it maintains the success rates on a publicly visible digital database. It is done using Distributed Ledger Technology (DLT). This, in turn, promotes transparency and trust among clients that their data will not be misused at any cost. The date, time and the unique payment identifier are all recorded systematically in the DLT system.

Blockchain in banking can also prevent the double-spending of money by consumers, as it uses a timestamp server, which places a hash on each block of transactions, and this record just cannot be tampered with.

On an ending note

Nowadays, we truly live in the Internet Age. There is next to nothing which we cannot avail at the tip of our fingers, quite literally. Our smartphones, tablets, laptops and PCs are our gateways to transverse the digital space. We can shop, browse, connect, learn, bank, and pay bills, all from these devices which have so grown to dictate our lifestyles.

Thus, we have explored how Blockchain technology can help to stall the myriads of threats that can disrupt the normal functioning of the BFSI sector.

Thus, we can say that blockchains are essentially a future-proof customer support strategy. This can effectively increase the safety and security of data in cyberspace.