Loan Chatbot: Automate End-to-End Loan Application Process

Loan Chatbot: Automate End-to-End Loan Application Process

Chatbots in banking services deliver superior customer experiences. Over the years, it has evolved to take up different banking functions, including

- assisting users with questions regarding their account balances or application processes,

- helping them transfer funds and pay bills,

- or even updating their profile information.

One of the most prominent use cases is through the loan chatbot.

Loan chatbots (for lending and mortgage) are upgrading financial services by building easy-to-use and long-lasting communication channels. On one hand, chatbots help borrowers obtain loans easily and quickly. On the other hand, lenders can sanction more reliable loans faster and follow up on debt recovery without human intervention.

Chatbots have too many use cases and benefits, mainly because loans come in different shapes and sizes, from student and home or mortgage loans to personal and auto loans.

To understand the role and importance of loan chatbots, we will cover the following topics in this article:

- Opportunity: Why are banks and financial services using loan chatbots?

- Challenges: What problems do users and institutions face in the lending process?

- Solution: How to use chatbots at different loan application and debt recovery stages?

Opportunity: Change in Trends Driving More Digital Lending

The loan and lending sector is rapidly growing in the digital age.

According to Marketsandmarkets, the global digital lending market will reach USD 20.5 billion by 2026 at a CAGR of 13.8%.

This growth is mainly due to changes in consumer behaviour. Three particular reasons include:

- Rapid smartphone sales and usage, increased visibility and awareness about loans.

- Upsurge in digitalisation makes it easy for borrowers to obtain loans in less time and in hindrances.

- Advances in the lending market with a rise in alternative loan options such as peer-to-peer (P2P) lending and loans from non-banking financial companies (NBFCs).

Due to these reasons, many lenders have seen a big jump in net profits for FY22 and expect this momentum to grow in FY23.

Challenges: Inefficient and Expensive Processes

For years, the lending industry has suffered from the inconvenience of manual loan approval systems. Consumers often need clarification on long and outdated application forms. And with no medium for doubt clearance, they have to resort to personal calls with company officials. This is a headache for both parties and increases the time taken for sanctions.

With multiple steps involved as the loan advances, some of the bottlenecks faced are:

- Multiple to and fro for required financial documents

- Unresponsive users or lenders

- Unclear rules on loan decisions

- Delay in information updates between departments

- Tracking customer information accurately

Manual processes also make way for the possibility of human error and inefficient compliance management. For example, asset appraisals may be wrongly scheduled, documents might go missing, and nominees may not match up – the list is never-ending. This leads to higher defaults down the line and may even invite legal troubles.

Even if a great team runs a loaning operation, the monotonous and repetitive back and forth wastes their skills and leads to sub-par customer experience.

Another challenge in the loaning process is debt recovery. With unresponsive customers, banking and financial institutions spend a lot on getting in touch with debtors and struggle with getting people to repay their debts. If borrowers infringe on contracts, it leads to legal battles, which are costly and lengthy processes.

Banking chatbots can help with most of these challenges. By automating these low-effort but high-impact areas of the process, customers get better experiences, employees can focus more on productive work, and the financial institution gets high net profits and ROI.

All finance-related services can be automated easily by integrating chatbots with finance CRM, enhancing overall efficiency and customer satisfaction.

Solution: How to Use Chatbots in Your Loaning Process

Now that we’ve gone over why you need a chatbot, the obvious question is – how to create or use a banking chatbot in the loaning process. A loan chatbot can automate the loan process from application submission, KYC, document verification, approvals, and post-purchase customer support. We list the top 7 tasks you should automate using a loan chatbot system for streamlined processes and better customer experiences.

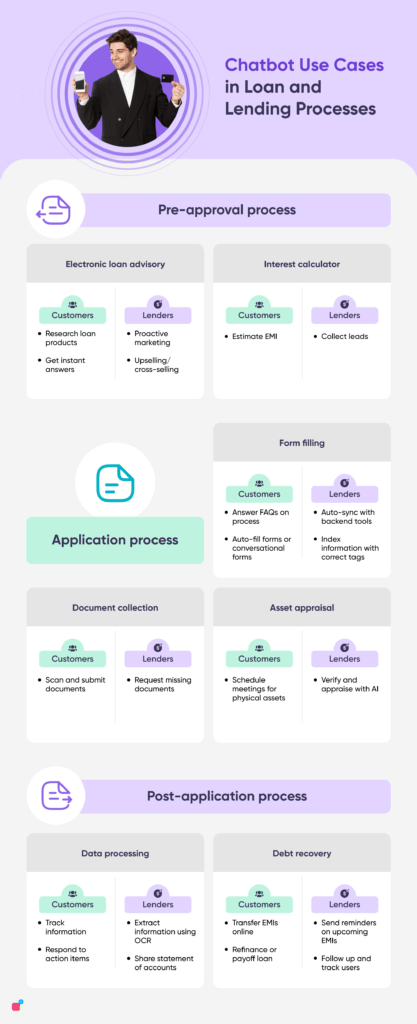

1. Electronic Loan Advisory

Even though there are nuances to every loan issued, most customers have similar intentions that can be understood by standard inquiry.

Using a set of pre-entered questions, chatbots can assist customers in

- choosing the best home loans,

- commercial property loans

- and other types of financing.

A chatbot for mortgages can instantly discern users’ aspirations and deliver relevant details.

Users can clear fundamental confusion via the faq chatbot and be assigned the perfect loan for their requirements. This way, service providers do not have to spend hours answering similar questions, and customers can return to the chatbot as often as needed. While interacting with customers, lenders can also upsell or cross-sell other products and services.

2. Interest Calculator

A loan chatbot solves a wide variety of challenges in the application processes, one of which is speedy interest calculation for applicants. Often, clients have a hard time gauging monthly instalments for their loans and can feel dejected when it turns out to be different from what they expected.

A chatbot can take inputs easily from interested parties and show them a breakup of their loan repayment plan. This helps lenders maintain transparency and keep client dissatisfaction minimal.

3. Application Process

Filling forms is tedious and time-consuming. And when it comes to finances, the terminologies are confusing as well. Another challenge in manually filling forms is that too many forms go to different departments. Hence, a user has to fill in the same information multiple times.

Chatbots can assist users during the process, helping them understand what information is required, explain terminologies, and answer any other questions they might have. Loan chatbots also use conversational forms, i.e. instead of a form, the questions are asked in conversations. With this, the questions are asked only once, and the chatbot will update the backend tools in all the relevant places. This saves both the borrowers’ and the lenders’ time, reducing errors in the information.

4. Document Collection and Validation

A loan without proper due diligence is a ticking bomb. Getting and consolidating all essential documents before issuing a loan is of utmost importance. However, due to the high number of applicants that reach out to banks and credit providers each day, the system could be more explicit.

Loan chatbots provide users with automated checklists of all the papers they need to provide and reduce defaults. Users can scan and submit documents while the lenders can verify these documents with AI in KYC. If any documents fall short, the lenders can follow up with the user and get the required documents.

5. Schedule Asset Appraisals

Asset appraisals are one of the essential parts of the loaning process, and they’re often what delays authorisation as well. Setting up evaluations using an AI-powered chatbot is hassle-free and allows customers to ask the banking chatbot questions. This ensures that no bad loans go unnoticed, and if the borrower cannot pay back the standing amount, the lender incurs no losses.

Chatbots can also assist in scheduling meetings to assess physical objects such as homes and properties. Scheduling a meeting can take weeks without a chatbot since it could be tough to match calendars. As the assessment is set up on a formal messaging system, there can be no complaints regarding missed appointments or alerts.

6. Data Processing and Storage

The crux of conversational banking is to derive all essential information regarding a client while making them feel more comfortable. But, if all the data received throughout the process isn’t stored correctly, the entire process becomes futile.

A loan or mortgage chatbot can always gather, retain, and recall data. With quick data collection from all existing and new resources, mortgage processing and underwriting are more structured. Faster data processing helps companies conclude whether an applicant should be assigned a loan within no time, cutting out hours of brainstorming that may be needed. There may be discrepancies in the figures reported by an individual but not those displayed by an AI system.

7. Debt Recovery

Loan chatbots make debt recovery much easier. From reducing their involvement in obtaining borrowers’ contact information to sharing real-time updates about repayments and EMIs. Regular updates sent to borrowers increase their chance of repaying promptly.

Chatbots in the lending sector also reduce the field collection agents’ time and effort. It can follow up with uncooperative borrowers and also share borrowers’ information with the field collection agents to track them.

Advantages of A Personal Loan Chatbot

A loan chatbot system is a perfect antidote to all the issues caused by manual loan approvals. With a significantly higher Turnaround Time (TAT), these AI-backed systems can unprecedentedly boost a company’s customer retention. As people can get loans on a high-priority basis, they’re more likely to turn to a chatbot-using financial company in their time of need.

Mortgage chatbot systems bring more agility and dependability to the table. Enhanced workflows and robotic process automation of backend processes lessen the chances of wrong entries and record every transaction correctly. It makes service providers better equipped to handle a high influx of clients.

Some of the advantages lenders see include:

1. Seamless Customer Experience

Loan chatbots bring the loan application process to the borrower’s fingertips. It streamlines the process, reducing the service time for loan approval. In addition to this, borrowers get a personalised experience based on their loan type and data on them. This helps strengthen interpersonal relationships with customers and lenders.

2. Cost-Cutting and Time Saving

By automating manual processes, lenders save a ton of money and time. With workflows and AI, automate paperwork processing and manual checking processes. This allows agents to focus on high-impact queries that would otherwise go unanswered.

Suggested Reading: Cutting Contact Center Costs with Conversational AI

3. New Market Share

Millennials are more comfortable texting and resolving issues on their own. A chatbot channel is a great way to communicate with them. A loan chatbot increases the potential customer base by capturing this market. And with the data collected, chatbots can also recommend other services.

4. Agent Productivity

Chatbots and conversational AI tools improve agent productivity 10x. They reduce the load of repetitive and simple queries, allowing them to work on challenging and complex queries. Working on these high-impact queries boosts their satisfaction and leads to happier agents. Conversational chatbots also provide agents with a unified customer profile and a single view of all chats across channels, reducing the time between tools.

Loan Chatbots: You Aren’t A-loan on This Endeavour

Loan chatbots are inarguably the future of banking and finance. They promote a culture of smart work in organisations and are highly cost-effective as they minimise the need for brute labour.

Messaging service collaborations such as Whatsapp chatbots or website-embedded systems work equally well for information transmission. All you need is a good chatbot template, and you’re set for success!

Verloop.io is the world’s leading conversational AI for customer support. We help our customers provide delightful support experiences to their users. When it comes to loan and banking services, we’ve helped brands such as ADIB, Scripbox, RakBank, Watania, etc. in streamlining their processes with AI chatbots. Check out how you can do the same by talking to our experts.