WhatsApp Chatbots for Banking with 9 Use Cases

- May 14th, 2025 / 6 Mins read

-

Harshitha Raj

WhatsApp Chatbots for Banking with 9 Use Cases

- May 14th, 2025 / 6 Mins read

-

Harshitha Raj

Imagine a customer needs to freeze their card immediately after noticing an unauthorised transaction. They open their bank’s WhatsApp channel, and within seconds, a chatbot assists them in freezing the card, to secure their account. No hold times, no red tape—just instant resolution.

This level of service isn’t just desirable—it’s becoming an expectation. Mckinsey’s research shows nearly 75% of customers expect support within five minutes. However, traditional banking systems struggle to meet this demand. Conversational AI solutions like WhatsApp Business API chatbots bridge this gap with automation, agent support, and real-time service enhancements to build customer relationships.

At its core, banking is not simply about profit, but about personal relationships.

Indian Banks are working in overdrive to service their 1.3 billion citizens. With over 950 million individuals on Aadhaar and 250 million on Jan Dhan, technology’s playing a big role in helping banks identify, service and support customers.

Suggested Reading: How Chatbots in Banking Are Improving Customer Experience

Challenges in Banking Support

Delivering exceptional customer service in banking isn’t easy. A 2023 study by Accenture revealed that 44% of customers switch banks due to poor service. As financial institutions attempt to balance high volumes of interactions with the demand for quick, secure, and personalised support, they face a host of challenges. Let’s explore these hurdles in detail:

1. High Query Volume

Banks are flooded with repetitive queries like account balances, transaction statuses, and branch locations. These routine questions overwhelm support teams, reducing their ability to handle complex cases.

Picture a customer stuck at an airport, needing urgent information on their credit limit. With traditional systems, they might wait in a call queue for ages. The result?

Frustration and potential loss of trust.

Now you must be thinking, how does it hurt your business?

Overloaded agents can’t focus on high-value queries, leading to longer resolution times and dissatisfied customers. This can be resolved by enabling a conversational support system in place. 60% of banking customers would prefer self-service options for simpler queries if they were available, saving time for both parties.

2. Inconsistent Experiences Across Channels

Customers expect seamless support whether they’re on WhatsApp, email, or the bank’s app. Unfortunately, disconnected systems often force them to repeat their issue multiple times.

For instance imagine a customer starts a loan enquiry via the app, switches to WhatsApp for follow-up, and is asked to repeat the details. The broken journey feels like a game of broken telephone—not fun when finances are involved.

Poor integration frustrates customers and creates inefficiencies. Research shows that 72% of consumers view seamless experiences as a top priority when dealing with banks.

3. Regulatory Complexity

Financial institutions operate in a maze of compliance requirements, from GDPR to local data protection laws. Ensuring that every interaction meets these standards can be a logistical nightmare.

Consider a scenario where an agent accidentally sends sensitive account information over an insecure channel. While it might seem like a small oversight, it can lead to significant legal repercussions and loss of customer trust.

A recent study highlighted that global banks collectively paid over $10 billion in penalties for regulatory breaches in 2022.

4. Limited Scalability

Traditional banking systems aren’t built to handle sudden spikes in customer interactions, such as during tax season or crises like natural disasters.

Imagine a surge in queries about loan deferments during a natural disaster. Without scalable systems, customers face delays, further adding to their distress.

Why does this matter?

In a competitive market, slow response times can push customers to more agile competitors. The latest report found that banks with scalable systems retained 25% more customers during high-demand periods.

These challenges aren’t just hurdles—they’re opportunities to innovate. By adopting tools like conversational AI, banks can overcome these pain points, creating efficient, secure, and delightful experiences for customers.

Opportunity

India’s first-ever financial institution is the best example of a bank that adapts with time.

The Bank of Bengal was established in 1806 and later grew into an industry behemoth – State Bank of India.

India’s banking ecosystem systems took off, with public sector banks like Bank of Baroda

Bank of India Bank of Maharashtra Central Bank of India Indian Overseas Bank entering the market.

Private sector banks like HDFC, Axis Bank, Kotak Bank, and ICICI Bank have made their mark too.

In fact, India alone has 12 public sector banks, 21 private sector banks, 49 foreign banks, and 43 regional rural banks.

The net result is thousands of banks that have millions of customers and handle billions of dollars. So how does a bank engage, interact and notify these many users?

Problem

But this opportunity comes with three major challenges – Scale, Security, and Language.

With thousands of new customers being added every day, scaling business functions like onboarding, customer support and upselling is extremely difficult. These are fundamentally human-intensive operations. And with a customer base in the billions, it’s almost impossible for human reps in proportion to growth.

Security is another major hurdle for financial institutions. While it is true that companies follow customers onto platforms, you can hardly imagine a bank sending customers notifications on TikTok. Banks lead the charge in the field of data security and need a tool that can match.

In a country as linguistically diverse as India, companies need to be able to speak the language of their customers. A bank headquartered in Mumbai has to be able to speak Kannada if it wants to service customers in India’s Silicon Valley.

A WhatsApp Chatbot for Banking allows companies to do all three, from the comfort of a customer’s phone.

Solution

So why do companies need to use a WhatsApp Chatbot for Banking?

Plain and simple, it’s better than all its alternatives.

A WhatsApp AI Chatbot is better than a form for generating leads. It’s better than phone calls for customer support and more effective than emails for customer engagement.

Messages delivered on WhatsApp see 3x the conversion of other channels. They also have a 100% delivery rate and a 95% open rate.

In this blog, we’ll run you through the best use-cases for a Banking WhatsApp Chatbot.

But first let’s understand how WhatsApp chatbot for banking can help you streamline your customer interactions:

WhatsApp Business API Features That Empower Banking Support

As part of Verloop.io’s offerings, WhatsApp Business API brings a suite of tools designed to streamline and enhance customer interactions in the banking sector. These features go beyond traditional messaging, providing banks with innovative solutions to handle complex workflows and elevate customer satisfaction.

1. Forms for Seamless Data Collection

Imagine a customer initiating a loan inquiry. Instead of redirecting them to a website or branch, the bank can send a pre-filled form directly within the WhatsApp chat. Whether it’s gathering KYC details, onboarding a new customer, or processing a service request, these forms ensure quick, secure, and hassle-free data submission. This approach reduces drop-offs and improves conversion rates.

2. Rich Media Messaging

Enhance customer communication with multimedia options like images, videos, and documents. For instance, banks can share explanatory videos about new credit card offers or send PDF statements securely. Rich media messaging ensures clarity and a more engaging experience.

3. Interactive Messages

Enable customers to take instant actions with interactive buttons for scheduling appointments, selecting services, or navigating FAQs. For example, a customer looking to block a lost debit card can use a pre-designed quick-reply button, speeding up issue resolution.

4. Broadcast Capabilities

Communicate with large customer segments efficiently. Announce policy updates, new offers, or reminders like EMI due dates through broadcast messages while ensuring personalisation. This feature saves time and keeps customers informed.

5. Two-Way Messaging

Unlike traditional SMS, WhatsApp facilitates real-time, interactive conversations. Customers can inquire about their account balance and immediately follow up with questions about transaction details, all within the same thread.

6. Templates for Efficiency

Pre-approved WhatsApp message templates reduce response time for banks, ensuring compliance while maintaining a personal touch. For example, transactional alerts, OTPs, or event reminders can be sent instantly and securely.

With WhatsApp Business API, banks are equipped to meet modern customer demands with solutions that combine convenience, security, and personalisation.

These capabilities pave the way for improved customer experiences and operational efficiency in banking. But the real power lies in applying these features to specific use cases. Let’s dive into the 9 most impactful ways WhatsApp chatbots can address the unique needs of modern banking.

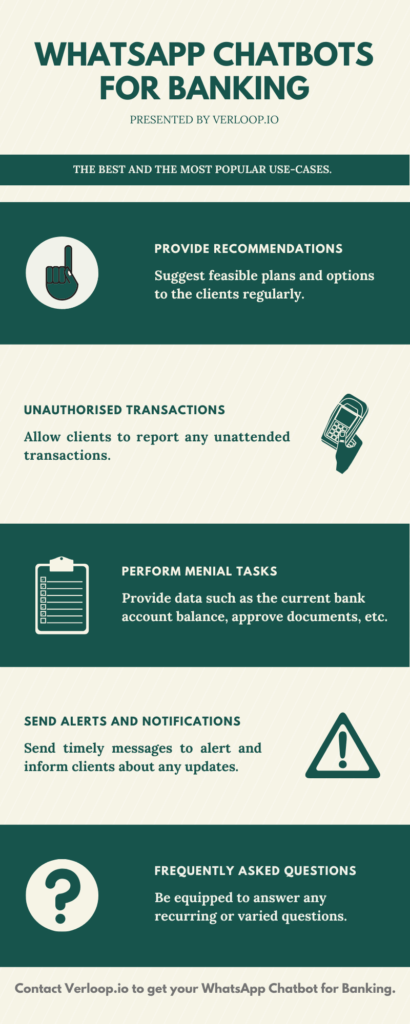

Here are top 9 use-cases for WhatsApp Chatbot for Banking:

By leveraging the power of WhatsApp Business API, banks can deliver a wide range of services directly through a messaging platform most people are already familiar with.

A) Customer acquisition

B) Customer support

C) Customer engagement

Customer acquisition

1. Generate leads

From the second they arrive, encourage prospects to become customers.

51% of Indians prefer online banking channels and around 26% of them would prefer using an online medium to perform their banking services rather than talking to a human agent.

In this video, we see John talking to a Plutus’ WhatsApp bot. Once John sends a message, his name and phone number are automatically collected and fed into a CRM.

2. Qualify prospects

Once a bank has collected a prospect’s contact details, they can now move to qualification.

In this scenario, John is interested in a home loan. The bot asks John questions about his yearly income, and tenure of the loan and displays his loan eligibility.

Quick and easy qualification allows customers to move through the sales funnel with ease.

3. Follow-up with potential customers

Even with a 10% conversion rate, you’re still losing out on 9 in every 10 of your potential customers.

If demand is defined as intent + ability to purchase, a lot of these lost leads are likely just stumbling at the last hurdle. A nudge and a push can help boost your conversion rates.

Retargeting lost leads can help boost overall conversion, ensuring improved topline revenue.

Customer support

4. Automate FAQs

The 80-20 rule plays a huge part in enterprise customer support. Over 80% of all customer queries stem from a 20% data set of questions.

These questions look like this –

- Did my transaction clear?

- How do I apply for a loan?

- What documents do I submit and where?

These simple questions come in the thousands and wreak havoc on human-operated support systems. With a WhatsApp Chatbot for Banking, however, you can automate these queries like the below.

Rather than waiting on the support agent to reply back via call/ email, customers can have their queries answered immediately and delightfully.

Suggested Reading: Customer Support Automation and Its Importance

5. Transfer high-level queries

Some queries NEED a human to intervene. With your low-level queries automated, you can empower your team to handle such make-or-break interactions.

Transfer chats from bots to agents with ease on WhatsApp. The bot can even identify customer intent and transfer the chat to a specific department when it can’t answer.

Ensuring that your human agents don’t miss a single ticket improves revenue vis-a-vis customer loyalty through higher NPS and CSAT.

6. Collect feedback

Collecting data on customer interactions allows companies to constantly grind out CX improvements.

However, feedback notifications that are sent by email/in-app often go unread.

With a 95% read rate and a 300% higher conversion rate, WhatsApp Chatbots are a great way to collect customer feedback.

Collect feedback at any customer funnel step to understand drop-off, churn and delight. Use Verloop.io’s reports to highlight these pain points so banks can constantly move towards better CX.

Customer engagement

7. Provide recommendations

Cross and up-selling to customers is the easiest way to drive revenue.

Existing customers are easier to sell to — by a long shot: You’re 60-70% likely to sell to an existing customer, compared to the 5-20% likelihood of selling to a new prospect.

Use a WhatsApp Chatbot for Banking to weaponize customer queries and offer them appropriate products.

8. Send alerts and notifications

WhatsApp’s high open, read and reply rates make it the ideal platform to send notifications on.

Send transactional notifications, alerts, and reminders on WhatsApp. Allow your customers to respond and ask questions when needed.

Informed customers are happy customers. Instead of relying on customers to frequently check their email, you should engage with customers on a platform they’re already comfortable on.

9. Upload documents

Customers have to share a wide variety of documents with banks on a day-to-day basis. The sharing of these documents usually represents an unnecessary hurdle during the sales funnel.

Billions of users send millions of documents on WhatsApp every day, given the platform’s low data usage and easy-to-use interface. So why shouldn’t banks?

Allow both agents and customers to exchange documents, images, and audio with each other with ease.

WhatsApp’s end-to-end encryption also ensures that this data moves securely.

If you loved reading this, you’d really like these articles as well:

WhatsApp Chatbots for FinTech- A complete guide

Loan Chatbot: Automate End-to-End Loan Application Process

Actionable Steps for Implementing WhatsApp Chatbots in Your Bank

Incorporating WhatsApp chatbots into your banking strategy can significantly streamline operations, enhance customer engagement, and drive cost savings. Here’s how to take action:

- Start by identifying repetitive and high-volume tasks that chatbots can handle, such as account inquiries, transaction history, and loan applications.

- Use customer data to personalize chatbot interactions and make offers that are highly relevant to individual customers.

- Track metrics like response times, customer satisfaction, and cost savings to gauge the success of your chatbot implementation.

- Make sure the chatbot smoothly hands over complex queries to human agents when necessary, ensuring customers receive the best possible support.

By acting on these steps, your bank can tap into the full potential of WhatsApp chatbots, providing faster, more efficient, and highly personalized services to your customers, while optimizing operational costs and boosting overall satisfaction.

Embrace AI-Driven Transformation with Verloop.io’s WhatsApp Solutions

WhatsApp Business API chatbots equipped with Conversational AI provide a practical way to address the modern challenges of banking support. By automating routine tasks, assisting agents with AI tools, and improving data-driven decisions, banks can offer a seamless experience that meets both customer and organisational needs.

Ready to enhance your banking support? Verloop.io is here to help.

FAQs

1. Can I use a chatbot on WhatsApp?

Yes, you can use a chatbot on WhatsApp. Businesses, including banks, can deploy WhatsApp chatbots to offer automated customer support, answer FAQs, assist with transactions, and provide personalised banking services securely.

2. How WhatsApp chatbots are used in banking?

WhatsApp chatbots in banking help customers check account balances, transfer funds, view transaction history, pay bills, request statements, and even apply for loans — all through secure, interactive conversations.

3. How can AI be used in banking?

AI in banking can be used for customer support through chatbots, fraud detection using predictive analytics, automated loan approvals, personalised financial advice, voice banking, and even regulatory compliance through intelligent data processing.

4. Is WhatsApp AI safe?

Yes, WhatsApp AI is safe when implemented correctly. WhatsApp uses end-to-end encryption to secure messages, and AI-powered chatbots must comply with data protection regulations like GDPR, ensuring customer data is kept secure.