Role of Voice Banking in 2025 Financial Services

- May 15th, 2025 / 5 Mins read

-

Aarti Nair

Aarti Nair

Voice banking is the new way to bank digitally in 2025 and beyond. Here’s why YOUR bank needs voicebots for superior customer experiences.

Voice Banking, conversational banking, or voice-based banking are all synonyms for enabling customer engagement for banking with the help of voice AI call platform. But you must be thinking, why would it make a difference if you adopt this technology for your banking business or other financial services?

Let us explain you with a short story.

Sarah had always dreaded calling her bank. The long hold times, endless menu options, and repeating her details to multiple agents made even a simple balance inquiry frustrating. But one evening, she tried something different. She spoke to her bank’s AI-powered voice assistant. Within seconds, it verified her identity, provided her balance, and even reminded her of an upcoming bill payment.

No waiting, no hassle.

This seamless experience is becoming the new standard. As voice banking evolves in 2025 with the power of generative AI, financial institutions are leveraging AI to offer faster, more personalised, and highly secure services. With 8.4 billion voice assistants already in use and the voice AI market projected to reach $47.5 billion by 2034, banks are embracing voice technology to improve customer interactions.

From hands-free transactions to AI-driven financial advice, voice banking is no longer a futuristic concept—it’s the next step in banking convenience. But how far can it go?

Let’s explore the role of voice banking in reshaping financial services in 2025.

What is Voice banking?

Voice banking enables customers to interact with their bank using voice commands instead of relying on traditional methods like phone calls, mobile apps, or in-person visits. With AI, Natural Language Processing (NLP), and now Large Language Models (LLMs) powered by Generative AI, voice banking has evolved beyond simple commands to offer more intelligent, context-aware conversations.

For example, a customer might ask, “How much did I spend on dining last month?” Instead of just listing transactions, an AI-powered voice assistant using LLMs can analyse spending patterns, provide a summary, and even suggest budgeting tips.

Banks are integrating voice banking across mobile apps, cloud telephony systems, smart speakers (like Alexa and Google Assistant), and IVR systems, making financial services more accessible. It also integrates with UCaaS ecosystem. With Generative AI, these voice assistants are now capable of understanding complex queries, predicting customer needs, and offering personalised financial insights—turning them into virtual financial advisors rather than just transactional tools.

Security remains a priority, with advancements in voice biometrics, multi-factor authentication, and fraud detection algorithms, ensuring that voice banking is not just convenient but also highly secure. As financial institutions embrace LLMs and Generative AI, voice banking is set to become more intuitive, proactive, and personalised than ever before.

As per a Cognizant survey, customer behaviour is changing from using the eyes to read text and fingers to swipe, to using voice and ears to talk and listen. Voicebots have a clear win here. They surveyed 1400 respondents and 80% of people felt voice AI has a game-changing impact on how the banking sector operates.

How Voice AI Technology is Reshaping Business Communication

Voice AI is no longer a futuristic concept—it’s rapidly becoming a core component of business operations. From customer service to internal collaboration, AI-powered voice assistants are transforming how businesses interact, automate, and scale.

Tech giants are racing ahead: OpenAI has expanded its Advanced Voice Mode, Microsoft has enhanced Copilot AI’s voice and reasoning abilities, and Meta has integrated voice AI into its messaging platforms. According to IBM Distinguished Engineer Chris Hay, these advances are game-changing:

“We’re entering the era of AI contact centers. Every small business can now offer enterprise-level customer service.”

At the heart of this revolution is real-time AI communication. With low-latency APIs reducing response times to under 200 milliseconds, conversations with AI are becoming seamless and human-like. Businesses can now deploy AI-powered voice agents at scale—enhancing customer experience, reducing costs, and unlocking new revenue streams.

- AI-Driven Contact Centers: Small businesses can now offer enterprise-level customer service with AI agents.

- Personalised AI Assistants: Companies like Meta are integrating celebrity-inspired AI voices for a more engaging experience.

- Fraud & Security Risks: As AI voices become more lifelike, verifying identities will be crucial for fraud prevention.

- Accessibility & Multilingual Support: Voice AI can break language barriers, making financial and government services more inclusive.

- The Future of Wearable AI: AI voice assistants may soon integrate with smart glasses and AR, enabling real-time, on-the-go assistance.

With the global voice AI market projected to reach $47.5 billion by 2034, businesses must adapt or risk falling behind. As LLMs and generative AI continue to evolve, the way we communicate with machines and each other is about to change forever.

Why Voice Assistants Are Essential in 2025 and Beyond

Consumer behaviour is shifting rapidly, driven by the demand for faster, more seamless interactions. People no longer want to navigate complex menus or type out queries—they expect instant, hands-free solutions. Voice technology is meeting this demand, integrating effortlessly into daily life. As per the PwC report:

- 90% of consumers are familiar with voice-enabled products, and 72% have used a voice assistant.

- Adoption is driven by younger consumers, high-income households, and families with children.

- 74% of users interact with voice assistants at home, showing a shift toward voice-first experiences for routine tasks.

As voice AI becomes more sophisticated, businesses that embrace this trend will create frictionless experiences, while those that ignore it risk losing relevance.

The Business Case for Voice Assistants

- Customer Expectations Are Changing: Consumers increasingly prefer hands-free, instant interactions. Businesses that fail to adapt may lose engagement.

- Voice-Driven Commerce Is Growing: 50% of consumers have made a purchase using their voice assistant, and 25% are open to doing so in the future.

- AI-Powered Customer Service: The rise of real-time voice AI APIs allows businesses to offer faster, more personalised support—no long wait times, no frustrating menus.

- Smart Home and IoT Influence: 89% of consumers consider voice assistant compatibility when purchasing smart home devices.

Challenges to Overcome while adopting Voice AI for Banking

While adoption is rising, businesses must address key barriers:

🚧 Trust & Security: 46% of consumers don’t fully trust voice assistants to process orders correctly.

🚧 Privacy Concerns: Users want more control over how their data is used.

🚧 Limited Awareness: Many users only leverage basic functions, missing out on advanced capabilities.

Consumer behaviour is evolving toward convenience and immediacy, and voice AI is at the forefront of this shift. Businesses that integrate voice technology into their strategy will lead the next era of customer engagement. The question is—is your business ready to adapt?

What can voice banking do today? Here are the top 5 voice bot use cases in banking

Voice banking is the technology powered by AI that allows users to access banking services through their words or voice commands. For example, a customer can either call their bank’s voicebot or talk to the official voice assistant and enquire about their account balance, locate a nearby ATM, block their card, etc.

There are many use cases of voicebots in the banking sector. We look at the top 5 in this blog.

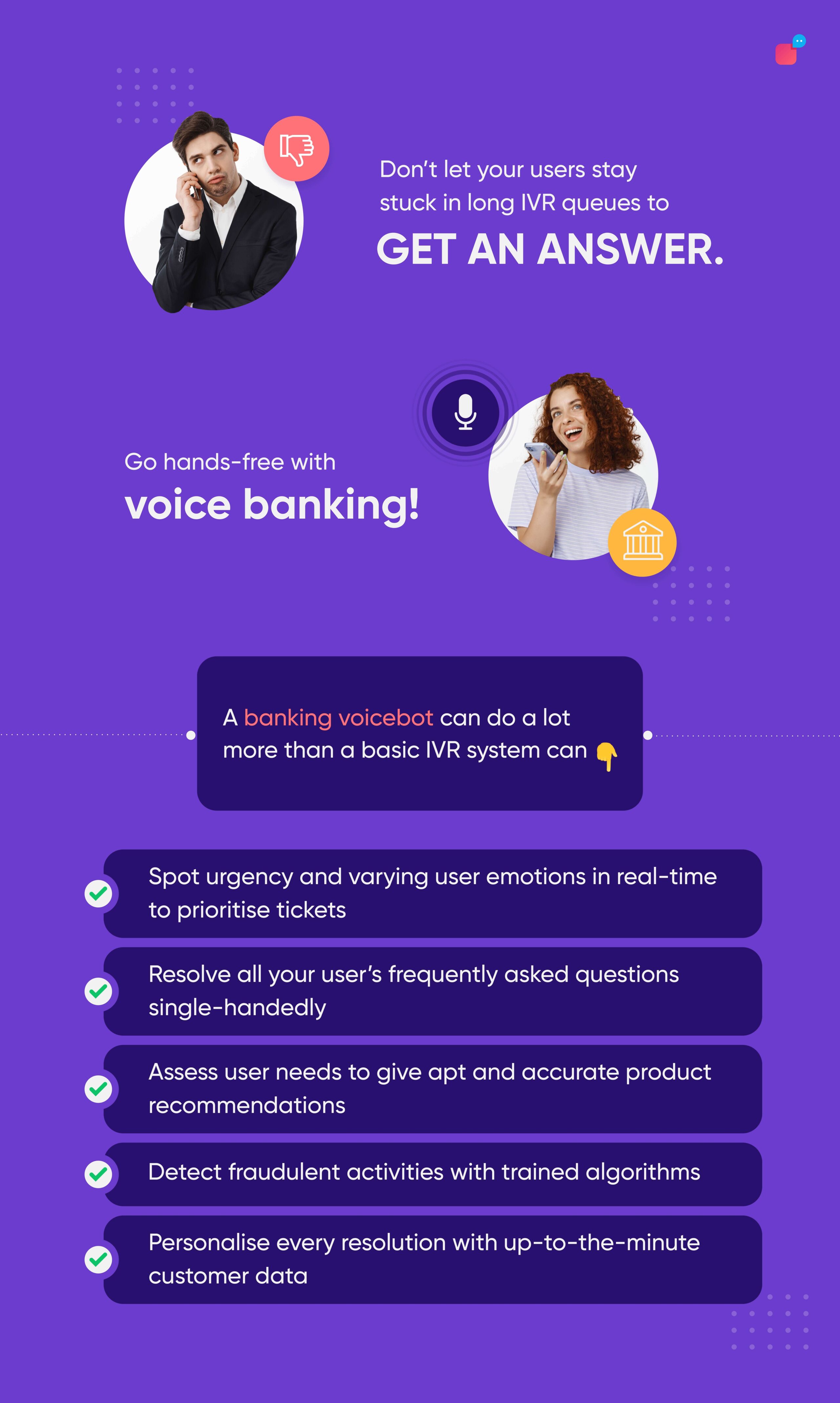

1. Customer support: resolve frequently asked questions right away

In the banking industry, customers usually across similar types of queries.

- What is my bank balance?

- Where is the nearest ATM?

- How to change the registered address with my bank account?

These are some of the most commonly asked questions every customer support team in a bank receives.

A voicebot can smoothly guide your users through these questions from A to Z. A smart voice banking bot can talk to your users like a live representative does, and lead them to apt resolutions. Because the response is quick, it reduces customers’ wait time and resolution time for FAQs.

This is exactly something a basic IVR lacks, a technology many banking services are still using. While an IVR can merely collect information and transfer it to an agent, a banking voicebot can alone resolve most level 1 questions. This frees up room and time for your agents to focus on more complex questions.

2. Upsell / Cross-sell: suggest intelligently

Customers are always looking for the best option from the range of services available. Let’s take the example of a credit card. A bank provides different types of credit cards, depending on your spending, the reward expectations, where the credit card can be used, interest rates, international usage, etc.

A voicebot can ask relevant questions and suggest the best option to the customer. It helps customers make decisions quickly and complete the purchase. And this kind of interaction is very personal, making the customer experience 10x better.

On the other hand, a traditional IVR system or a website does nothing but delivers generic product suggestions. Voice banking can go a step further and suggest products based on the account information (demographic, account type, etc.) and interaction history too. Intuitive, smart suggestions that are personalised can make all the difference.

3. Detect fraudulent activities right away

As technology advances, so do new ways of cybercrime. People place a lot of trust in banks and it’s important for banks to keep funds protected in every way they can. Fraudulent activities can be detected and flagged by voicebot AI’s state-of-the-art fraud detection algorithms.

A quick-witted voice banking chatbot can pick up on various verbal and behavioural cues in the speaker’s vocal input to detect fraud before it occurs. How can you train your banking voicebot to do this?

- Review and analyse past fraudulent calls

- Use a dataset of common phrases and keywords scammers use

- Use a performance sheet to flag calls based on these trigger phrases

A big advantage voicebots have in the banking sector over traditional IVR (or the bank’s website) is their ability to map emotions and urgency in the user’s speech. AI powers voicebots with sentiment analysis to understand the tone and emotion in the user’s speech. It helps identify the right user, and note the urgency in their speech.

You can train a voicebot to identify conventionally fraudulent behaviours. This way you can mitigate risks as and when they come. Talk about keeping customers loyal, keeping their data safe is the first step.

4. Personalise interactions: stay ahead on customer info with tech integrations

No two customers can be alike. And so, one of the biggest drawbacks IVR systems and banking websites today have is the lack of personalisation. Every user will have different questions to be answered and varying expectations to be fulfilled.

A smart voice banking bot will know your customer’s details (through your CRM) and even your customer’s preferences (through your marketing automation tool) before it can give an educated, well-thought-out response. Your tech integrations will let you gather data as and when needed.

5. Loan and Debt Recovery: Follow up and engage customers better

Customers use banks for getting loans and credit cards. Customers then pay EMIs to settle the debt. Banks involved in such services, have to follow up with customers in loan or debt collection.

Voicebots can be used to send reminders to these customers. And since these are bots, customers are more comfortable talking to them honestly than with humans as they feel it’s less judgemental.

But is voice banking safe?

One of the top concerns for the banking industry is safeguarding their clientele’s financial information. Security reigns supreme for financial institutions.

Voice technology is evolving rapidly and a lot of leading researchers are using AI to improve voice recognition technologies. When a user calls a voicebot, the AI matches the user’s voice with several unique identifiers.

In addition, if something looks out of the ordinary, AI triggers a whole set of measures to ensure there’s no breach in security. In a nutshell, the future is bright for security in voice banking.

Refining and getting your voice AI ready for the banking support future

Voicebots are built with simplicity in mind. Using voice is natural to the users. Calling customer service is a familiar action and faster too. Today, customers are looking for convenience and voicebots are delivering on it.

Inefficient IVR systems have alienated customers from phone banking. But voice banking chatbots will change that with quick, efficient responses that save time, money and a lot of worries.

A research study by Strategy& at PWC shows that banks can become efficient by up to 35% by deploying voice AI across their front and back-end processes.

Verloop.io is the leading voicebot technology provider for customer support teams. Our Voice AI is fortified with proprietary NLP and spoken language understanding (SLU), our offering support to people as, when, where, and however they need it.

Learn how you can use a voicebot to improve your customer support experience by talking to our experts!

FAQs

1. How long does voice banking take?

Voice banking is designed to be quick and efficient. Most voice banking transactions, like checking account balances, making payments, or transferring funds, can be completed in under a minute. However, complex queries may take slightly longer.

2. How does the voice banking process work?

Voice banking works through automated voice recognition technology. When a customer calls the bank’s voice banking system, they interact with an AI-powered voice assistant that understands their requests, verifies their identity, and completes the requested actions, such as balance checks or payments.

3. What is automated phone banking?

Automated phone banking is a self-service system that allows customers to perform basic banking transactions over the phone without speaking to a human agent. It uses voice recognition or keypad inputs to guide customers through options like balance inquiry, fund transfer, and bill payments.

4. Is voice banking safe?

Yes, voice banking is safe when implemented with robust security measures. It typically includes voice biometrics, multi-factor authentication, and data encryption to protect customer information from unauthorised access.

5. What do you need to enable AI voice banking for bank support?

To enable AI voice banking for bank support, you need:

-

An AI-powered voice recognition system (like Verloop.io’s Conversational AI).

-

Secure cloud infrastructure to store and process voice data.

-

A robust telephony system for seamless call management and voice processing.

-

Integration with the bank’s core systems for real-time transaction processing.

-

Compliance with data protection regulations (like GDPR or CCPA).

-

Customisable user workflows to ensure smooth customer interactions.