Loan Chatbot: Automate End-to-End Loan Application Process

- July 24th, 2025 / 10 Mins read

-

Aarti Nair

Aarti Nair

Loan Chatbot: Automate End-to-End Loan Application Process

- July 24th, 2025 / 10 Mins read

-

Aarti Nair

Aarti Nair

Need a loan? Don’t phone it in—chat it out (or talk it out).

Think back to the last time you applied for a loan. Was it smooth sailing… or did it feel like filing taxes during a Wi-Fi outage?

Endless forms, long queues, hold music that could haunt your dreams—traditional processes haven’t exactly earned customer love.

Now imagine this: A customer asks “Am I eligible for a home loan?” at 2AM—and gets an instant, accurate answer. No waiting, no paperwork, no jargon. Whether it’s via chat or voice, AI is quietly reshaping how financial institutions engage borrowers.

In fact, all the top 10 commercial banks in the US have rolled out chatbots as part of their customer service strategy. And people are actually using them—37% of Americans interacted with a bank chatbot in 2022. That number?

Only going up. But the real leap?

We’re moving from robotic, rule-based scripts to AI-powered Voice and Chat Agents built on large language models (LLMs). These agents don’t just spit out FAQs, but instead they can walk customers through eligibility, recommend loan types, even handle KYC or remind them of EMI due dates. And they do it conversationally, whether typed or spoken.

For lenders, this means lower support costs, better lead qualification, and fewer dropped journeys. For borrowers, it’s faster answers, less paperwork, and a whole lot less “please hold.”

In this guide, we’ll unpack what loan chatbots and Voice AI Agents can really do, how banks are using them, and how you can pick the right one for your needs. Whether you’re running a credit union, digital-first NBFC, or traditional bank—this is your cheat sheet for future-ready lending support.

Let’s dive in—no signatures required.

To understand the role and importance of loan chatbots, we will cover the following topics in this article:

- Opportunity: Why are banks and financial services using loan chatbots?

- Challenges: What problems do users and institutions face in the lending process?

- Solution: How to use chatbots at different loan application and debt recovery stages?

Opportunity: Change in Trends Driving More Digital Lending

What’s fuelling the shift from paper-heavy, in-person loan approvals to instant approvals from your phone screen? Short answer: everything.

We’re not just talking about convenience anymore—digital lending has evolved into a full-blown movement. According to Mordor Intelligence, the U.S. digital lending market alone is projected to hit $801 billion by 2029. That’s a lot of zeros and a lot more opportunities for lenders and borrowers alike.

But what’s driving this growth? The answer lies in a mix of technological maturity, changing borrower expectations, and business necessity. Let’s unpack the trends turning loan desks into digital dashboards.

AI and Machine Learning are no longer experimental. Banks and NBFCs are now using these technologies to make faster, smarter credit decisions. Lenders can analyse massive datasets in real time to assess risk, detect fraud, and even personalise repayment plans. For the borrower, this means fewer forms and faster answers—often within minutes.

Embedded Finance is another game-changer. You’re buying a fridge online and—boom—a “0% EMI” offer appears without you ever stepping into a bank. Loans are now being woven directly into the platforms where purchases happen. Not only does this shorten the lending funnel, but it also opens up access to those who might never have applied otherwise.

But speed alone isn’t enough. The simplified user journey has taken centre stage. Lending platforms are obsessing over UI/UX like tech startups—because no one wants to pinch and zoom their way through a form on their phone. From seamless onboarding to conversational bots guiding the entire process, ease is the new currency.

Then there’s automation—the unsung hero. From pulling your CIBIL score to sending EMI reminders, automation reduces human error, cuts costs, and speeds up the entire loan lifecycle. For institutions, this means scaling without burning out their ops team.

And let’s not forget smart lending—lending that actually listens. With AI-driven personalisation, borrowers no longer get cookie-cutter loan plans. Instead, terms are tailored based on real-time financial behaviour, spending patterns, and risk profiles. It’s lending with a human touch, minus the human queue.

Alternative credit data is also breaking open the credit ecosystem. Don’t have a traditional credit history? No problem. Your rental payments, utility bills, and even social behaviour can now paint a more complete financial picture. This is a massive leap for financial inclusion, especially in rural markets and among first-time borrowers.

Meanwhile, Voice AI Agents and Chatbots are taking centre stage in customer communication. Forget waiting in a call queue—borrowers can now get answers, start applications, and even upload documents through natural conversations, whether via WhatsApp, website chat, or a voice call.

Voice AI makes it even simpler for users with limited literacy or comfort with typing to engage with lenders. Need help in Hindi, Marathi, or Arabic? No problem. Today’s AI agents don’t just understand language—they understand context.

And yes, security’s had a glow-up too. With rising threats comes rising defence. From biometric logins to GenAI-powered fraud detection, cybersecurity in lending is becoming smarter, not just stronger.

Whether it’s Buy Now, Pay Later, real-time micro-loans, or blockchain-based smart contracts, digital lending is no longer a side project—it’s the main show.

So, where do chatbots and Voice AI agents fit in? Right at the core. They’re not just helping lenders reduce operational load; they’re shaping borrower experiences at scale—with accuracy, speed, and empathy.

What’s Holding Borrowers Back? Challenges That Still Plague the Lending Journey

Let’s face it—while the lending industry has taken great digital leaps, the actual borrower experience often feels like it’s still stuck in the early 2000s.

Ever applied for a loan and felt like you were being interrogated rather than supported?

You’re not alone. Many borrowers, especially first-timers and those outside major metros, still find the loan process intimidating, opaque, and painfully slow. But why is that?

Endless Paperwork and Repetition

Borrowers are often asked to submit the same documents multiple times—PAN card, income proof, and bank statements. Didn’t I already upload that on page 3?

Manual document verification slows everything down and frustrates applicants who just want to know if they’ve been approved.

Poor Communication and Long Wait Times

“Your call is important to us. Please stay on the line…” That’s a familiar tune. Many banks and NBFCs still rely on overloaded call centres, leaving borrowers waiting days for a basic update on loan status or repayment queries. With rising demand and leaner ops teams, customers often feel like they’re shouting into the void.

Lack of Personalisation

Ever received a loan offer that had nothing to do with your needs? That’s the result of rigid systems offering one-size-fits-all products. Without intelligent systems that adapt based on user behaviour or context, lenders risk missing the mark—and the market.

High Drop-Off Rates During Application

Let’s be honest—no one wants to fill out a 20-field form on their phone. Long, clunky application processes cause many users to abandon midway, especially when the language is too technical or the interface isn’t mobile-friendly.

Low Credit Penetration in Tier 2/3 Cities

Despite the digital boom, many semi-urban and rural borrowers remain underserved. Why? A mix of language barriers, fear of formal banking, and lack of awareness. Traditional banks can’t scale human-led support fast enough to bridge this gap.

Limited Support Outside Business Hours

Financial stress doesn’t stick to a 10-to-5 schedule. But support often does. Customers looking for help on EMIs, eligibility, or document uploads late at night usually hit a wall—unless there’s an intelligent assistant available 24/7.

Compliance and Fraud Risks

From identity theft to loan stacking, lenders walk a regulatory tightrope. Manual verification and human oversight often aren’t enough to flag red flags in real-time—leading to delayed disbursements or worse, bad loans.

These challenges aren’t just pain points—they’re deal-breakers. And as loan products diversify and borrower expectations rise, solving them isn’t optional anymore. It’s urgent.

That’s where AI-powered chatbots and voice agents step in. Not as gimmicks, but as real, scalable solutions built to smoothen the lending journey—for everyone involved.

Shall we explore how? 👇

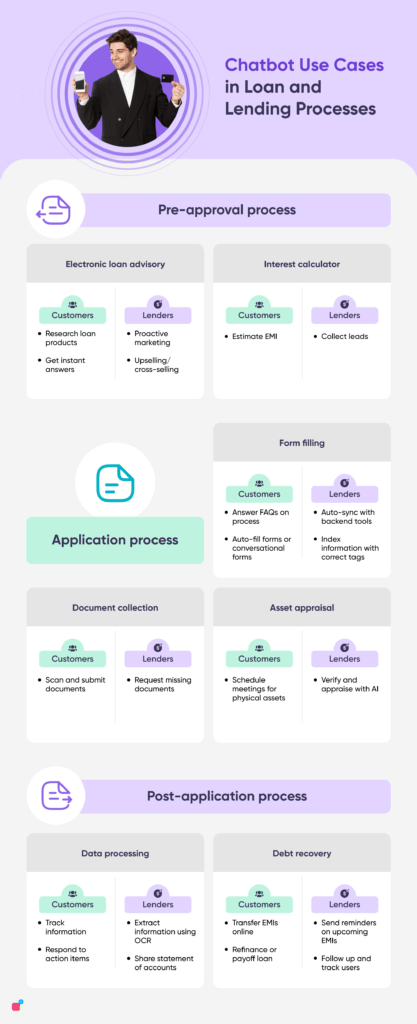

Solution: How to Use Chatbots in Your Loaning Process

Now that we’ve gone over why you need a chatbot, the obvious question is – how to create or use a banking chatbot in the loaning process. A loan chatbot can automate the loan process from application submission, KYC, document verification, approvals, and post-purchase customer support. We list the top 7 tasks you should automate using a loan chatbot system for streamlined processes and better customer experiences.

1. Electronic Loan Advisory

Even though there are nuances to every loan issued, most customers have similar intentions that can be understood by standard inquiry.

Using a set of pre-entered questions, chatbots can assist customers in

- choosing the best home loans,

- commercial property loans

- and other types of financing.

A chatbot for mortgages can instantly discern users’ aspirations and deliver relevant details.

Users can clear fundamental confusion via the faq chatbot and be assigned the perfect loan for their requirements. This way, service providers do not have to spend hours answering similar questions, and customers can return to the chatbot as often as needed. While interacting with customers, lenders can also upsell or cross-sell other products and services.

2. Interest Calculator

A loan chatbot solves a wide variety of challenges in the application processes, one of which is speedy interest calculation for applicants. Often, clients have a hard time gauging monthly instalments for their loans and can feel dejected when it turns out to be different from what they expected.

A chatbot can take inputs easily from interested parties and show them a breakup of their loan repayment plan. This helps lenders maintain transparency and keep client dissatisfaction minimal.

3. Application Process

Filling forms is tedious and time-consuming. And when it comes to finances, the terminologies are confusing as well. Another challenge in manually filling forms is that too many forms go to different departments. Hence, a user has to fill in the same information multiple times.

Chatbots can assist users during the process, helping them understand what information is required, explain terminologies, and answer any other questions they might have. Loan chatbots also use conversational forms, i.e. instead of a form, the questions are asked in conversations. With this, the questions are asked only once, and the chatbot will update the backend tools in all the relevant places. This saves both the borrowers’ and the lenders’ time, reducing errors in the information.

4. Document Collection and Validation

A loan without proper due diligence is a ticking bomb. Getting and consolidating all essential documents before issuing a loan is of utmost importance. However, due to the high number of applicants that reach out to banks and credit providers each day, the system could be more explicit.

Loan chatbots provide users with automated checklists of all the papers they need to provide and reduce defaults. Users can scan and submit documents while the lenders can verify these documents with AI in KYC. If any documents fall short, the lenders can follow up with the user and get the required documents.

5. Schedule Asset Appraisals

Asset appraisals are one of the essential parts of the loaning process, and they’re often what delays authorisation as well. Setting up evaluations using an AI-powered chatbot is hassle-free and allows customers to ask the banking chatbot questions. This ensures that no bad loans go unnoticed, and if the borrower cannot pay back the standing amount, the lender incurs no losses.

Chatbots can also assist in scheduling meetings to assess physical objects such as homes and properties. Scheduling a meeting can take weeks without a chatbot since it could be tough to match calendars. As the assessment is set up on a formal messaging system, there can be no complaints regarding missed appointments or alerts.

6. Data Processing and Storage

The crux of conversational banking is to derive all essential information regarding a client while making them feel more comfortable. But, if all the data received throughout the process isn’t stored correctly, the entire process becomes futile.

A loan or mortgage chatbot can always gather, retain, and recall data. With quick data collection from all existing and new resources, mortgage processing and underwriting are more structured. Faster data processing helps companies conclude whether an applicant should be assigned a loan within no time, cutting out hours of brainstorming that may be needed. There may be discrepancies in the figures reported by an individual but not those displayed by an AI system.

7. Debt Recovery

Loan chatbots make debt recovery much easier. From reducing their involvement in obtaining borrowers’ contact information to sharing real-time updates about repayments and EMIs. Regular updates sent to borrowers increase their chance of repaying promptly.

Chatbots in the lending sector also reduce the field collection agents’ time and effort. It can follow up with uncooperative borrowers and also share borrowers’ information with the field collection agents to track them.

Use Cases for Loan Chatbots and Voice AI Agents

So we’ve talked about the bottlenecks—now let’s talk breakthroughs.

What if applicants didn’t have to call or wait in queues to check their loan status? What if Tier-3 customers could apply for loans in their native language at midnight, without a single human involved?

That’s not some sci-fi pitch—it’s what smart lenders are already doing with AI chatbots and voice agents.

Let’s break it down.

1. Faster Application Assistance

Picture this: A self-employed user in Jaipur starts a loan application at 11 PM. Halfway through, they’re stuck on “collateral documentation.” In the traditional setup, they’d either give up or wait until morning. But with a loan chatbot, they get instant help—“Upload your property deed or vehicle ownership papers here”—in Hindi, within seconds.

No delays. No drop-offs. Just 24/7 guidance.

2. Document Collection Made Easy

Chatbots can handle document uploads, validate file formats, and even send nudges when uploads are missing. Instead of follow-up calls from agents, applicants get auto-reminders:

🟢 “Hi Ravi, we’re still waiting for your salary slips to proceed with your loan. You can upload them here.”

For lenders, that’s fewer manual follow-ups and faster processing.

3. Real-Time Loan Eligibility Checks

Chat and voice AI agents can instantly run eligibility checks using pre-fed models. Based on responses like income, credit score, or employment type, the bot can say:

🟢 “You may be eligible for a ₹3L personal loan with 11.5% interest. Want to proceed?”

No more forms sent back and forth. Just instant clarity and conversions.

4. Multilingual Support Across Channels

India is home to 22+ official languages—and the UAE even more Arabic dialects. Voice AI agents trained in local dialects can answer questions like:

🟢 “मुझे मेरा लोन बैलेंस जानना है” or “سحب القرض الخاص بي متى سيكون؟”

This makes banking inclusive for users who aren’t fluent in English, improving reach and trust.

5. Fewer Calls, Better CSAT

Voice AI agents can handle high call volumes—think “What’s my EMI due date?”, “How do I close my loan?”, “I want to increase tenure.” These agents reduce hold time and enable first-call resolutions, which is a game-changer given only 5% of contact centres hit 85%+ CSAT scores.

With AI, lenders don’t just improve response speed—they deliver consistency, accuracy, and 24/7 availability.

6. Fraud Detection and Compliance Automation

Using AnswerFlow and secure document parsing, AI chatbots can flag inconsistencies—like mismatched PAN names, invalid bank account numbers, or expired documents—before a loan is approved. Lenders can set up audit trails for every step, reducing compliance headaches and risk.

This isn’t just about saving cost (although that’s a bonus). It’s about building trust at scale and creating a loan experience that feels intuitive, helpful, and fast—across text and voice, in every language your borrowers speak.

And if you’re wondering where to start—Verloop.io’s Loan AI Agent makes this plug-and-play. It combines chatbot and voice AI flows with built-in compliance, multilingual support, and easy CRM integrations. Lending, the way it should be.

How to Implement AI Chatbots and Voice Agents in Your Loan Journey

You don’t need to overhaul your tech stack overnight to benefit from automation. Implementing AI chatbots and voice agents can start small—and scale fast.

Think of it like building a lending assistant that gets smarter with every borrower it helps.

1. Map Your Loan Workflow First

Before picking tools, map out your existing loan journey. Where are customers dropping off? Where do agents spend the most time repeating themselves?

Most banks and NBFCs discover the same friction points:

-

Application drop-offs

-

Document upload follow-ups

-

Eligibility queries

-

EMI reminders

-

Manual onboarding

These are all ripe for automation.

2. Start with One or Two High-Impact Use Cases

Rather than trying to automate everything at once, focus on the biggest wins.

📍For chatbots: Start with “Loan Eligibility Calculator” or “Document Checklist Assistant.”

📍For voice AI: Begin with automating “EMI Date Reminders” or “Loan Status Updates.”

Once live, these flows will start saving agent hours from day one.

3. Integrate with Your Core Systems

Your AI chatbot or voice agent is only as powerful as the data it can access.

With Verloop.io, you can easily integrate with:

-

LOS (Loan Origination System)

-

Document verification APIs

-

KYC modules

This enables seamless, secure conversations. So when a borrower asks, “What’s my loan number?” or “Have I submitted all documents?”—the bot knows the answer instantly.

4. Add Local Language and Voice Support

Loan applicants aren’t just urban, English-speaking users anymore. With Verloop.io, you can train your voice agents in multiple Indian languages and dialects like Tamil, Marathi, or Bengali—or Arabic dialects in UAE.

This is critical for increasing financial inclusion.

5. Use Pre-Built Flows and Templates

Verloop.io’s Loan AI Agent comes with ready-to-use templates for common use cases:

-

Eligibility flow

-

Application FAQs

-

Loan calculator

-

Repayment reminders

-

KYC document collection

-

Delinquency reminders

-

Foreclosure queries

That means faster go-live, lower dev dependency, and proven journeys that already work for leading lenders.

6. Ensure Security and Compliance

AI doesn’t mean you skip due diligence. Choose a vendor that’s ISO, SOC2, and GDPR compliant. Make sure document uploads are encrypted and stored safely.

With Verloop.io, you also get access to AnswerFlow, which allows you to upload policy PDFs, SOPs, or RBI circulars—and let bots answer user queries from them with 90%+ accuracy.

Done right, your AI loan assistant doesn’t just reduce costs—it improves borrower trust, reduces time-to-disbursal, and boosts NPS.

Advantages of A Personal Loan Chatbot

A loan chatbot system is a perfect antidote to all the issues caused by manual loan approvals. With a significantly higher Turnaround Time (TAT), these AI-backed systems can unprecedentedly boost a company’s customer retention. As people can get loans on a high-priority basis, they’re more likely to turn to a chatbot-using financial company in their time of need.

Mortgage chatbot systems bring more agility and dependability to the table. Enhanced workflows and robotic process automation of backend processes lessen the chances of wrong entries and record every transaction correctly. It makes service providers better equipped to handle a high influx of clients.

Some of the advantages lenders see include:

1. Seamless Customer Experience

Loan chatbots bring the loan application process to the borrower’s fingertips. It streamlines the process, reducing the service time for loan approval. In addition to this, borrowers get a personalised experience based on their loan type and data on them. This helps strengthen interpersonal relationships with customers and lenders.

2. Cost-Cutting and Time Saving

By automating manual processes, lenders save a ton of money and time. With workflows and AI, automate paperwork processing and manual checking processes. This allows agents to focus on high-impact queries that would otherwise go unanswered.

Suggested Reading: Cutting Contact Center Costs with Conversational AI

3. New Market Share

Millennials are more comfortable texting and resolving issues on their own. A chatbot channel is a great way to communicate with them. A loan chatbot increases the potential customer base by capturing this market. And with the data collected, chatbots can also recommend other services.

4. Agent Productivity

Chatbots and conversational AI tools improve agent productivity 10x. They reduce the load of repetitive and simple queries, allowing them to work on challenging and complex queries. Working on these high-impact queries boosts their satisfaction and leads to happier agents. Conversational chatbots also provide agents with a unified customer profile and a single view of all chats across channels, reducing the time between tools.

Loan Chatbots: You Aren’t A-loan on This Endeavour

Loan chatbots are inarguably the future of banking and finance. They promote a culture of smart work in organisations and are highly cost-effective as they minimise the need for brute labour.

Messaging service collaborations such as Whatsapp chatbots or website-embedded systems work equally well for information transmission. All you need is a good chatbot template, and you’re set for success!

Verloop.io is the world’s leading conversational AI for customer support. We help our customers provide delightful support experiences to their users. When it comes to loan and banking services, we’ve helped brands such as ADIB, Scripbox, RakBank, Watania, etc. in streamlining their processes with AI chatbots. Check out how you can do the same by talking to our experts.

Frequently Asked Questions (FAQs)

1. What is a loan chatbot, and how does it work?

A loan chatbot is an AI-powered assistant that automates customer conversations across channels like WhatsApp, websites, and mobile apps. It can answer FAQs, collect documents, guide borrowers through the application process, and even calculate eligibility—all in real time.

2. How is a voice AI agent different from a chatbot?

While a chatbot communicates via text, a voice AI agent interacts with customers over phone calls. Voice agents are useful for managing high call volumes, delivering reminders, or handling follow-up conversations in natural language—especially for borrowers who prefer speaking over typing.

3. Can AI chatbots handle sensitive data securely?

Yes. Leading platforms like Verloop.io offer end-to-end encryption, role-based access control, and compliance with industry standards such as ISO, GDPR, and SOC2. This ensures borrower data—such as PAN, Aadhaar, or income details—is handled securely.

4. What are the key use cases of loan automation via chat or voice?

Some of the most impactful use cases include:

-

Loan eligibility screening

-

EMI and payment reminders

-

Application status updates

-

KYC document collection

-

Recovery and delinquency reminders

-

Foreclosure and balance queries

5. Do these solutions support multiple Indian or regional languages?

Absolutely. Verloop.io’s AI agents support multiple Indian languages like Hindi, Tamil, Bengali, and Marathi, as well as Arabic dialects, making the experience inclusive for diverse borrower segments.

6. How long does it take to deploy a loan chatbot or voice agent?

With pre-built templates and API integrations, solutions like Verloop.io can go live in as little as 2–4 weeks, depending on the complexity of your workflows and integrations required.

7. Can AI agents help reduce operational costs?

Yes. By automating repetitive queries and tasks, lenders can reduce their dependency on large support teams. In fact, conversational AI is projected to cut service costs by up to $80 billion globally over the next few years.

8. What is AnswerFlow and how is it useful in lending?

AnswerFlow lets you upload documents like SOPs, RBI guidelines, loan policies, etc., and the chatbot or voice agent can answer user queries directly from these documents with high accuracy. It’s especially useful for compliance and regulatory-heavy processes.