Drive Customer Success with Customer Support Automation

Transform your support operations with streamlined automation, all from one holistic Gen AI platform and see the ROI firsthand.

Craft a natural customer journey with human-like conversations, welcome clients with personalised messaging, and conclude interactions in their preferred channels and language.

Co-pilot for support and, AnswerFlow aids agents in delivering top-notch customer service instantly. By actively listening to conversations, it streamlines tasks, and offers support with responses, rephrases, summarises, and more.

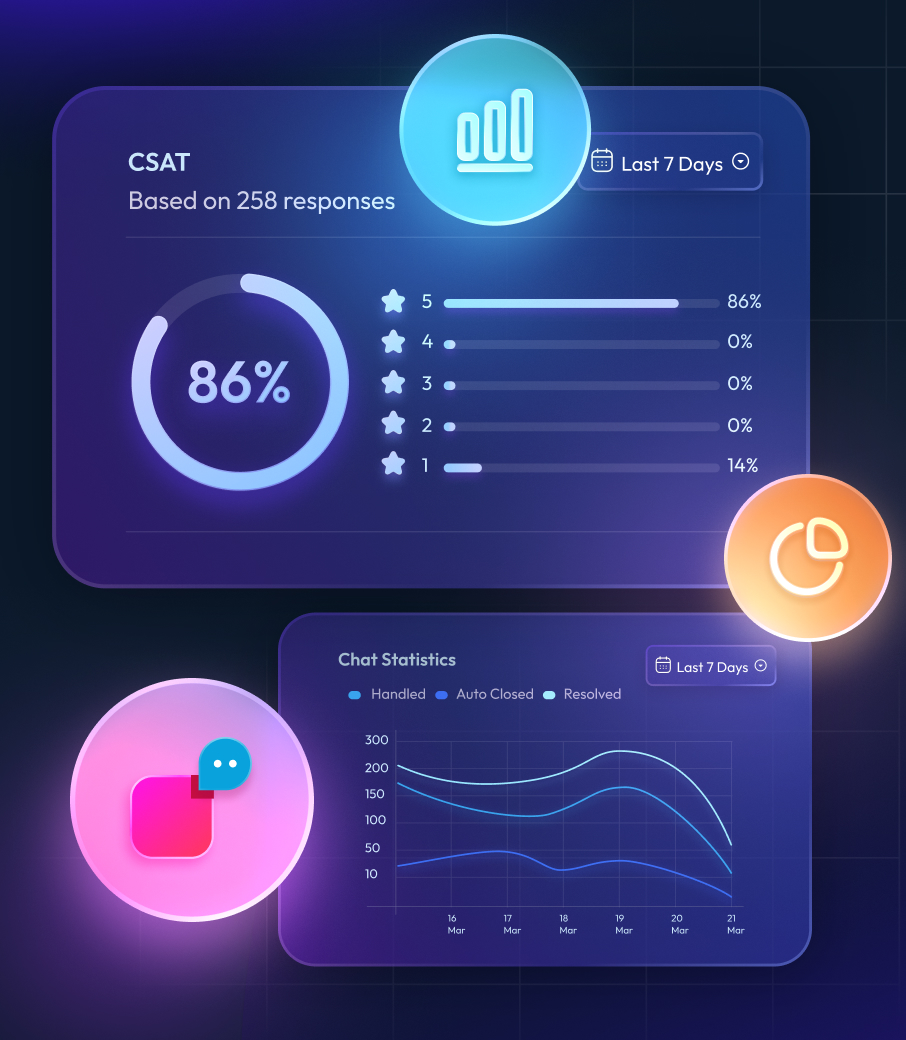

Empower support teams with insights like CSAT, conversation status, and KPIs at a glance, while optimising agent performance with activity dashboards.

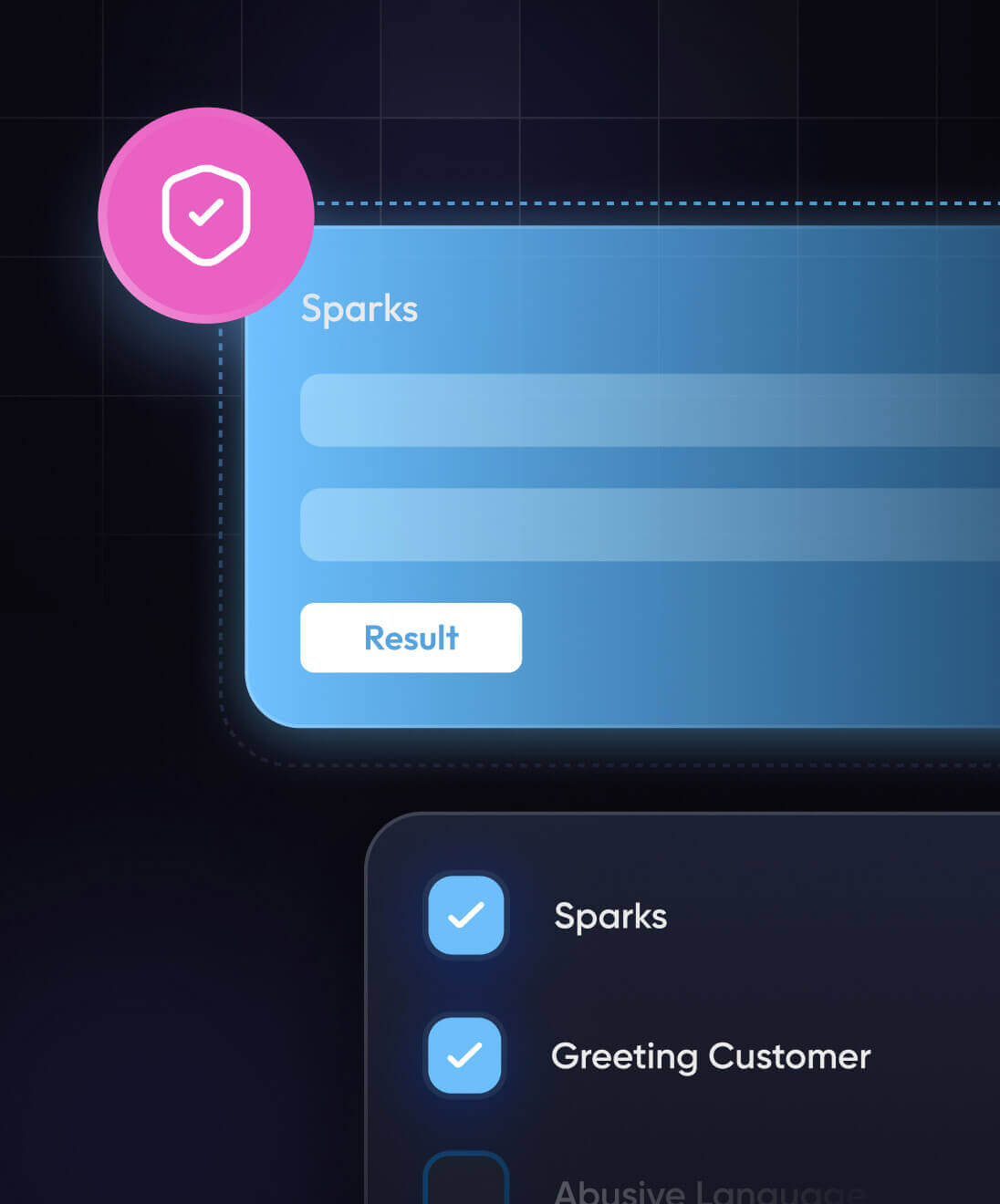

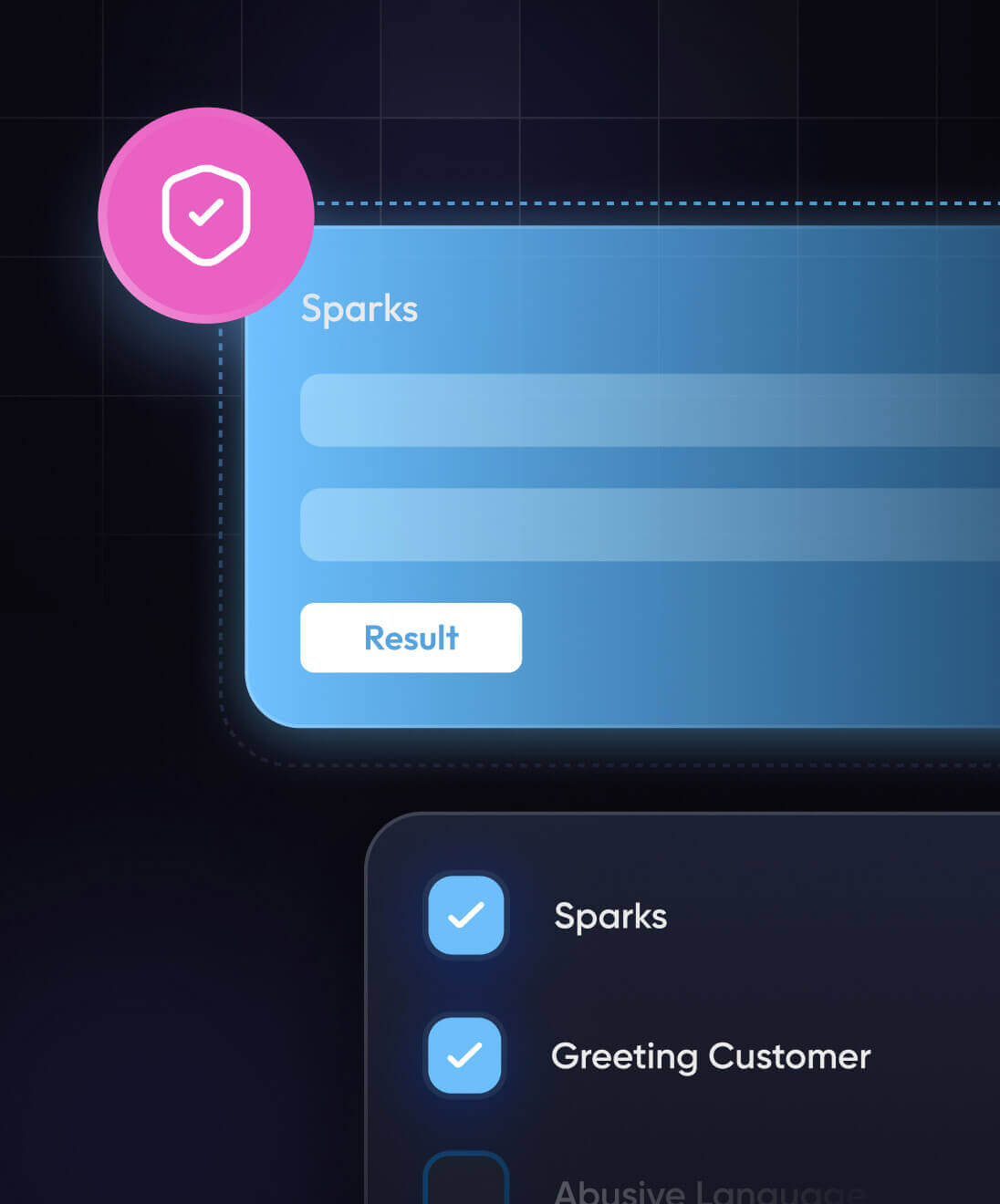

Gen AI-powered Sparks– a catalyst for transforming your contact centre into a high-performing, customer-centric organisation. Get detailed data of conversations and run analysis in a few minutes

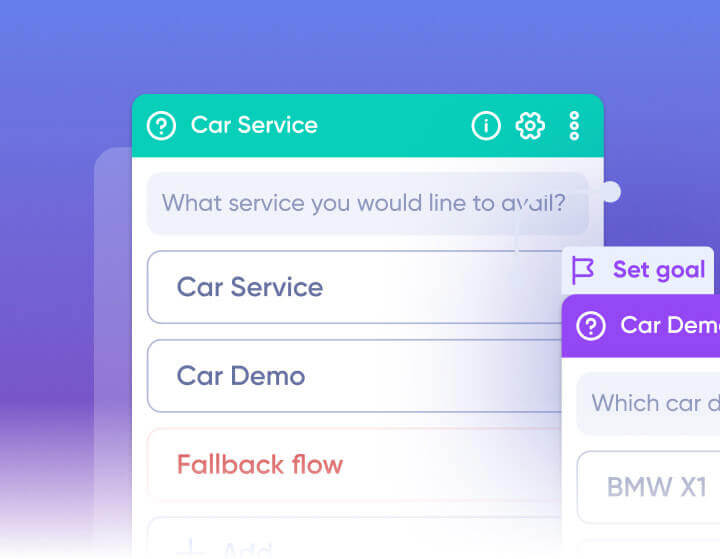

Strategise your goal and enlist Gen AI’s assistance in constructing a tailored conversation and agent assistance framework.

Flow

Construct conversation flows and set up documents on our intuitive dashboard to improve response time for bot and agents.

Iteratively test and optimise automation rules for heightened accuracy, ensuring alignment with existing processes and desired outcomes.

Publish your rules and allow our platform to analyse every interaction, delivering comprehensive insights.

Iteratively test and optimise automation rules for heightened accuracy, ensuring alignment with existing processes and desired outcomes.

Adaptive Intelligence, Built for Your Business

A prominent contact center implemented our Gen AI solution to automate their support operations and enabled agents to respond to customers more swiftly, resulting in a 40%* reduction in support costs.

Tailored to Your Business

Agile and Flexible

Publish with Confidence

Frequently asked questions

Verloop.io stands out with its specialised voice and chat AI agents, purpose-built for multilingual, intent-aware support across industries like BFSI, ecommerce, and telecom.

Verloop.io excels with deep integrations, context retention, fallback logic, and AI workflows that mimic real agent decision trees for high-resolution accuracy.

AI automation helps reduce ticket volumes, handle repetitive queries instantly, and route high-priority issues faster. It boosts agent productivity, ensures 24/7 support, and enhances CSAT by responding quickly and accurately across voice and chat.

Verloop.io enables automation across voice/phone, chat, WhatsApp, Facebook Messenger, Instagram, and web. Its AI is optimised for both inbound and outbound conversations, allowing businesses to scale customer engagement with minimal manual effort.

Absolutely. Verloop.io’s AI handles FAQs, order tracking, appointment bookings, and verifications automatically. This frees agents to focus on complex conversations, improving both efficiency and customer satisfaction.

Verloop.io is ISO 27001, GDPR and ISO/IEC 42001 certified, ensuring enterprise-grade data privacy, audit trails, and responsible AI practices. It's built to handle sensitive PII data while remaining compliant with evolving regulatory standards.