Revolutionizing Customer Support in the Takaful Industry: Watania Takaful’s Success Story

Headquarters

Dubai

Industry

Insurance

Use Cases

Agent Transfer, sales, WhatsApp Business API, Facebook Chatbot, Website Chatbot, Omnichannel post-sales support, multilingual support

For those unfamiliar with Takaful, it’s an Islamic insurance system rooted in mutual cooperation and shared responsibility. It provides a Shari’a-compliant alternative to conventional insurance. The global Takaful market, valued at $30.5 billion in 2022, is anticipated to surge to $97.17 billion by 2030.

Some of the challenges and opportunities for the takaful industry include regulatory frameworks, product innovation, customer awareness, and social responsibility. Watania Takaful, a company headquartered in Dubai, UAE, and with branches in Sharjah, Deira, and Abu Dhabi, encountered comparable hurdles.

But before we tell you more about their challenges and how they were able to overcome it, let me quickly tell you about Watania Takaful.

Watania Takaful provides a range of takaful products, including motor, health, travel, home, and personal accident coverage. It operates in compliance with Islamic Shari’ah principles and UAE Federal Law. In 2021, Watania Takaful merged with Noor Takaful, solidifying its position as one of the foremost takaful providers in the UAE.

As a prominent takaful provider, Watania Takaful consistently encounters a multitude of inquiries ranging from claims processing, policy renewals, purchasing new insurance policies, to general queries, and even the registration of complaints. This diverse array of customer interactions is a testament to Watania Takaful’s widespread presence across the UAE region and the diverse needs of its clientele.

With no presence of a unified platform, customers had to rely on either visiting the branches or IVR systems for the needful. Thus increasing the resolution time of any query or sales.

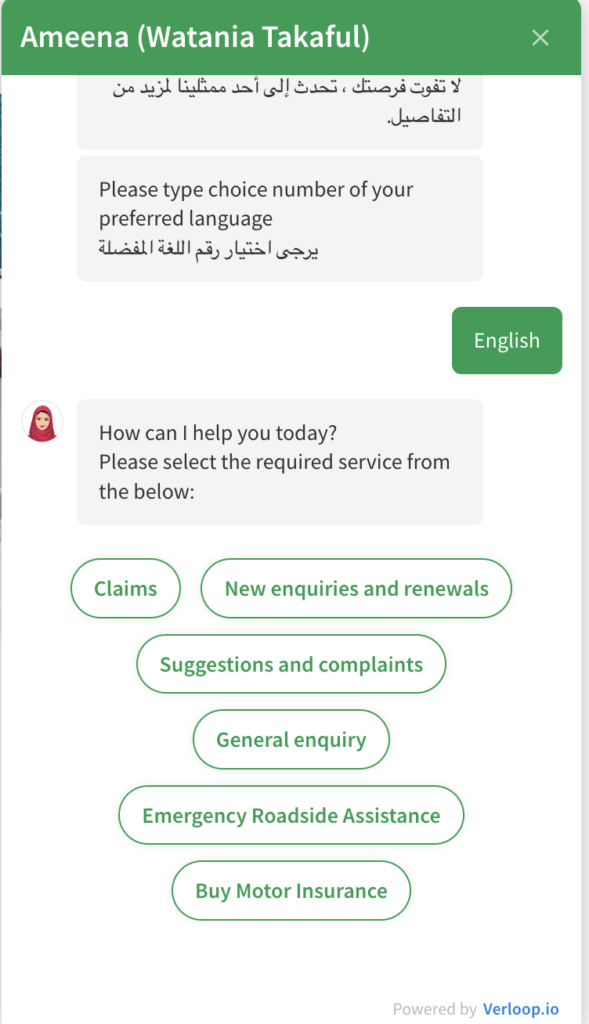

Considering the encountered challenges and the diverse customer base, Watania Takaful, in collaboration with Verloop.io, introduced an omnichannel, multilingual customer support system across various platforms:

They unveiled the Conversational AI platform, offering seamless interactions in both English and Arabic. This bilingual capability significantly broadened their accessibility and catered to a wider audience base, ensuring that customers could engage comfortably in their preferred language.

The conversational AI solution was launched to resolve the following queries:

The average bot deflection rate showcases the number of queries resolved without the aid of agents. And for Watania Takaful, the bot deflection improved by 54.36%.

The average number of returning users across different platforms, seeking assistance or purchasing new insurance policies, experienced a notable improvement of 14.89%. This signifies an enhanced engagement and satisfaction level among their customer base.

Previously, the typical resolution time for takaful queries spanned several days. Now, this duration has been dramatically shortened to an average of just 13.09 hours, vastly enhancing the efficiency and responsiveness of the process.

As a result of enhancements in both bot deflection and resolution time, the overall customer satisfaction score saw a remarkable improvement, surging by an impressive 47.7%. This indicates a substantial rise in customer contentment and successful query resolutions.

“Watania Takaful’s adoption of Verloop.io’s Conversational AI Platform resulted in a transformation of customer support, demonstrating the potential of AI-powered solutions in the takaful industry. This success story showcases how technology can revolutionise customer experiences in the insurance sector.” – Watania Takaful