How Voicebots Became the Innovative Tool of the Payments Industry

How Voicebots Became the Innovative Tool of the Payments Industry

E-Commerce industries are overloaded with transactions with a myriad of customers. One efficient way to make these transactions smooth while contributing and giving back to the business is automation. This is the reason why voice bot solutions significantly impact e-commerce. It provides the customer with an upscale experience, which is the cause for its rising appeal in the E-commerce sector.

Table of Contents

- What are voice payments?

- How do voice payments work?

- Challenges of voice payments

- Use cases a Voicebot can automate

- Benefits of voice payments

What are voice payments?

Conversational AI voice bots are a group of technologies that teach machines to understand human language and the meanings conveyed by words. Voice Payments bring in the element of artificial intelligence in payments, and a user can simply command a payment, and the process would be done! These voice commands may be as simple as answering questions with a simple Yes or No or slightly more complicated and involve Natural Language Processing (NLP). Voice payments enable users to make payments by speaking into their mobile phones.

According to a Gartner analysis, AI bots expect to account for 40% of all customer care conversations. Voice bots quickly catch up to chatbots, now the most popular artificial intelligence (AI) communication tool. Voice bots are AI-driven computer programmes. When answering our questions or guiding us to someone else, voice bots function similarly to chatbots, but they do it by listening to our voice instructions.

Suggested Reading: Voice AI: The Ultimate Guide

How do voice payments work?

Setting up a voice payment account is quite similar to using any online wallet to make a payment. Customers must first connect the information from their bank account or credit/debit card to their gadgets. But in a typical wallet situation, the user would have to launch the app, physically type in the recipient’s information and the amount paid, and then push the “ok” button to complete the transaction.

Nevertheless, with voice payments, the user only needs to tell their gadget to make the payment using their voice. Then the following things will happen:

- The end-user is confronted by a screen asking for consent when the chosen payment app opens.

- The customer can authorise the transaction via a password or a quick biometric scan.

- The recipient will be sent a confirmation message of the sum received through email, text, or in-app alert on the other end of the transaction.

- The reverse procedure goes just as quickly. Tell your device to ask one of your friends to send you money, and the person on the other end will receive a message asking them to confirm the request.

Customers can view their financial accounts, keep track of their payment schedules, and make purchases.

Challenges of voice payments

Voice payments face many of the same difficulties every new technology faces: unfamiliarity and mistrust. Like any breakthrough technology, voice-enabled payments must demonstrate how they serve a need and get additional credibility because money is involved for them to be widely adopted.

The following are the main difficulties that voice payments now face:

1. Security and privacy

A recent study found that customers still have trouble believing in technology they cannot physically touch or see. Customers root for about cutting-edge technology but fear that the same technology may become overly personal.

2. Accents

Voice assistants still need help comprehending various accents, particularly those that aren’t American. Since many Voice Assistants in the market are trained with data tweaked and gathered from America, a lot of them have trouble comprehending words that aren’t pronounced with the accents that they’re familiar with.

3. Point of service (POS) integration

To guarantee widespread adoption, voice-activated technology must be compatible with the hardware and software at the POS of retailers. However, most of the costs associated with integrating Wi-Fi and Bluetooth-enabled systems must be borne by merchants, which poses a significant barrier.

4. Banking institutions

As was already indicated, many well-known brands in the financial industry have begun embracing voice payments. Due to limited roll-outs and the need for significant global collaboration with banks, voice payments are moving slowly.

Use cases of voicebots in the payment industry

Voice bots assist in addressing the issues that contact centres face by lowering workloads and operational expenses while providing clients with quick, effective, and autonomous service.

1. Managing calls

Banks occasionally launch an outbound marketing campaign. Voice bots can assist banks by making hundreds or even thousands of cold calls to potential clients. What’s more exciting and resourceful about these calls is that voice interactions can enlighten customers with valuable insights into their individual needs and behaviours regarding payments, enabling companies to offer personalised services with a distinctive, unique brand experience.

Voicebots can converse with clients in a way that is natural-sounding and human-like. They can optimise certain information from a consumer regarding their data and schedule calls for various objectives. They can translate the human speech content into text with the help o

2. Qualifying leads

Voicebots help to generate and maintain a high conversion rate. Automated lead qualification with the help of voicebots enables more leads to be processed in a much shorter amount of time. Without the help of voicebots, a sales team member will have to manually enter and process the data, not being able to utilise that precious time to go into lead conversion.

Voicebots can easily filter the data and categorise between leads to accommodate agents to converse with the right customers and transfer calls to specific agents when a customer is interested to sign up for a service.

3. Customer verification

An agent must verify the customer’s identification before they can assist with a question about their bank account. This typically results in lengthy backlogs and can be challenging to scale up. Banks can manage the customer verification process using voice bots without interacting with people.

The payment voice bot can ask the caller for information about their data, quickly check it against the system, and verify their identification. The exact process performs for thousands of customers at once. They were putting a stop to misplaced or stolen credit and debit cards. This is the most helpful capability that banks can give voice bots when seen from the perspective of the client experience. Customers will immediately have to speak with an agent worried about the possibility of theft from their account or credit line.

4. Conducting customer satisfaction surveys

Satisfied customers add the best value to any business, and it becomes important to receive honest feedback on specific products and services. This is when a voicebot can take over and streamline the process, which elevates any customer retention strategy.

The voicebot can collect opinions of a variety of customers on a sensitive and significant topic like payments and incorporate ways into which this feedback can be executed wisely by the authority in charge, also while keeping different customer preferences in mind.

5. Assisting in the functioning of banking

The voice bot for payment is optional to transfer the call to an agent immediately after the client’s identity has been confirmed. It can perform various functions independently, including checking the account balance, sending money, and checking credit scores, among other things.

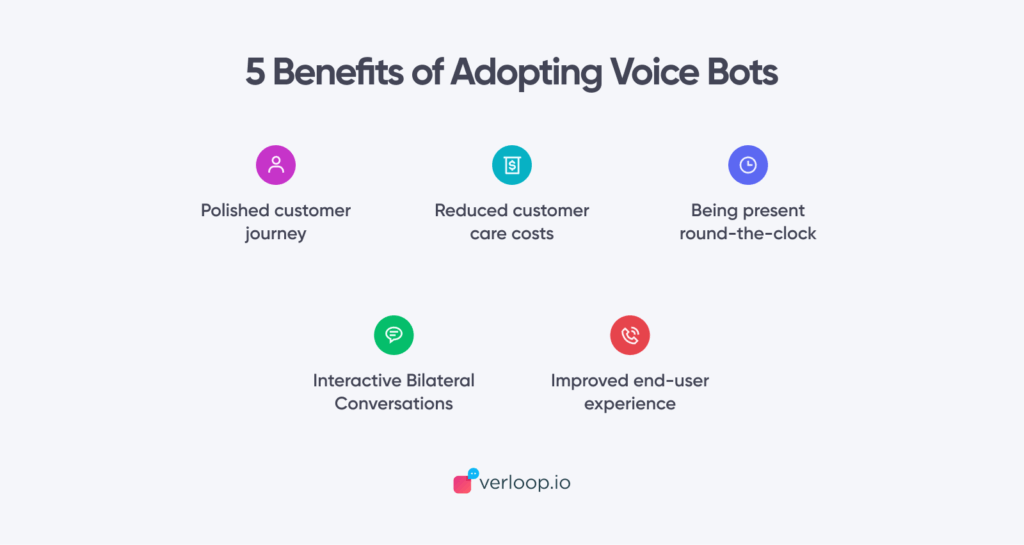

Benefits of voicebots in the payments industry

Voice bots have numerous advantages for company operations. The following are the main benefits of investing in speech automation:

1. Interact with consumers with cutting-edge voice bot technology

With advances in NLP science, intelligent voice control bots can now mimic the subtleties of speech. To understand it, it is necessary to hear about this evolution of natural language. This can be an excellent add-on for businesses to foster and nurture customer relationships.

2. Business procedures can be scaled up

Businesses train the bot to handle two or more chats simultaneously. On the other hand, voice bots have no such restrictions and can have multiple conversations with customers regarding payments of all kinds. This can help a business manage a high volume of tickets for payments.

3. Handing off

Voicebots can know when to refer a client to a person. Even though they are knowledgeable and sophisticated, voice bots won’t always be able to provide the correct solutions. For example, a voicebot can have trouble comprehending a payment request; in that case, the query can be shifted to a live agent. It can result in a good experience for the customer and a well-handled request for the company.

4. Superior customised partnerships

Voice-based interactions open new avenues for creating customised relationships. Voice bots, for instance, may instantaneously verify a consumer using voice recognition, and they can adapt their responses based on the user’s past interactions with a company. This can encourage a higher sense of security and trust within a customer for the company regarding as sensitive a topic as payments. It can also smoothen, fasten and simplify the entire transaction.

5. Reduced operational costs

Providing customer service 24×7 in the payments industry can be reduced drastically by using intelligent voice tools, considering that the cost of manpower, recruitment, training and onboarding can be heavy on the pocket for businesses. A voicebot can instead take over and automate and simplify the entire process while keeping the customers happy and meeting their needs.

6. Enhanced CX

Reduced wait times, quick responses and swift resolutions to payment queries and complaints can improve customer satisfaction and a customer’s overall experience. This can further result in a high rate of customer retention which is more profitable for businesses rather than newer customer acquisitions.

Bottom Line

With the ease and accessibility that voicebots offer customers, they are becoming an inseparable tool of E-commerce. They’re essentially altering and adding subtle nuances to how users search for products while making purchases. It gives customers an outstanding shopping experience and makes it simple for them to browse. This is thereby positively impacting the performance of a business and adding the element of trust between customers and businesses!

Verloop.io’s voice AI technology helps companies in the payments industry automate and streamline their methods with the help of voice bots. To save time and multiply efficiency, schedule a demo with one of Verloop’s conversational experts!