WhatsApp Chatbots for Fintech – A Complete Guide

WhatsApp Chatbots for Fintech – A Complete Guide

Banks are some of history’s premier institutions. Built on trust and efficiency, the banking industry is the definition of old money. But ready to take a bite out of the big apple is a new breed of financial firms, leveraging technology and data to serve customers quicker, faster and cheaper. We discuss how WhatsApp Chatbots for Fintech can help them.

Asia is leading the way in consumer adoption of financial technology products. In China and India, the most populous nations in the world, more than half of adult consumers active online said they regularly use fintech services, according to a 2017 survey conducted by Ernst & Young.

With over 276 fintech unicorns globally, no other industry vertical pumps out more $1+ billion firms. In fact, more than 1/3rd of the $12 billion raised by fintech firms in the first half of 2018 went to Asian companies.

As of 2021, more than 35 of the 276 fintech unicorns are Asian. That number is set to skyrocket by virtue of India’s contribution to the field.

Consider the Unified Payments Interface, or UPI, for short.

With over 115 lenders, UPI transactions in India reached $4.91 trillion in May 2021. Digital payments like these are expected to grow 7% m-o-m and account for nearly one in two dollars spent in the region.

The market for e-wallets is expected to grow even faster, from $22 billion in 2019, to $114 billion, a more than fivefold jump, by 2025.

Opportunity

Indian firms are all playing to leverage this large market through Conversational AI for the fintech industry.

With over 900+ registered financial technology firms, India’s 1.2 billion unserviced, but tech-savvy users are in safe hands.

Companies like PayTm, MobiKwik, PhonePe, LazyPay have made waves in the industry raising hundreds of millions of dollars.

Old-money institutions have taken notice too, with HDFC, Kotak 811 Banking and other such banks offering technology-driven products and services.

"The major winners will be financial services companies that embrace technology."

From simple one-click interactions like balance checking to complex multiple API actions like booking flight tickets, the move towards a cashless economy is slow but certain.

Problem

For a great example of the struggles of the Indian fintech market, consider the story of the fintech startup, Kaarva.

Kaarva provides financial support services to employees. Users can control their salaries and access them whenever they need them, multiple times a month. The company serves 100,000+ users across tier I, II and III cities in India.

While it’s great to have hundreds of thousands of customers, serving these customers presents a unique challenge.

India’s diversity operates across spectrums. From social and economic to demographic and importantly linguistic. Indian users don’t use a lot of apps, but they speak a lot of languages.

Providing consistently excellent support to an Indian marketplace is a hurdle that defies many a company.

Fintech companies need a channel that marries security, personalization, and vernacularism with popularity, speed and ease of use.

Solution

Kaarva identified a solution for this problem early in their journey.

Kaarva runs its operations almost exclusively on WhatsApp, from onboarding to customer service. Instead of draining its resources by hiring a large team for customer support, Kaarva automated its various functions using a WhatsApp Chatbot for Fintech.

Kaarva’s CEO and Harvard Business School alum, Khushboo Maheshwari, explained this choice.

WhatsApp is the platform everyone is on. 2 billion monthly active users from across socioeconomic, geographical and linguistic boundaries. Using WhatsApp’s Business APIs, we can automate our lead generation, onboarding and customer support; tracking customer journey every step of the way.

To understand how fintech companies can see the same gains that Kaarva did, let’s go through some of the use-cases a WhatsApp Chatbot can help you with.

Let’s create a hypothetical customer, and let’s call him Kevin.

Through this blog piece, we’ll chart the journey that Kevin will take during an average interaction with a FinTech company, from start to finish.

But what’s a hypothetical customer without an equally hypothetical company?

We’ll call our company PayQuick. PayQuick will be a traditional fintech firm, that offers bill payments, money transfers, and ticket bookings.

Let’s begin.

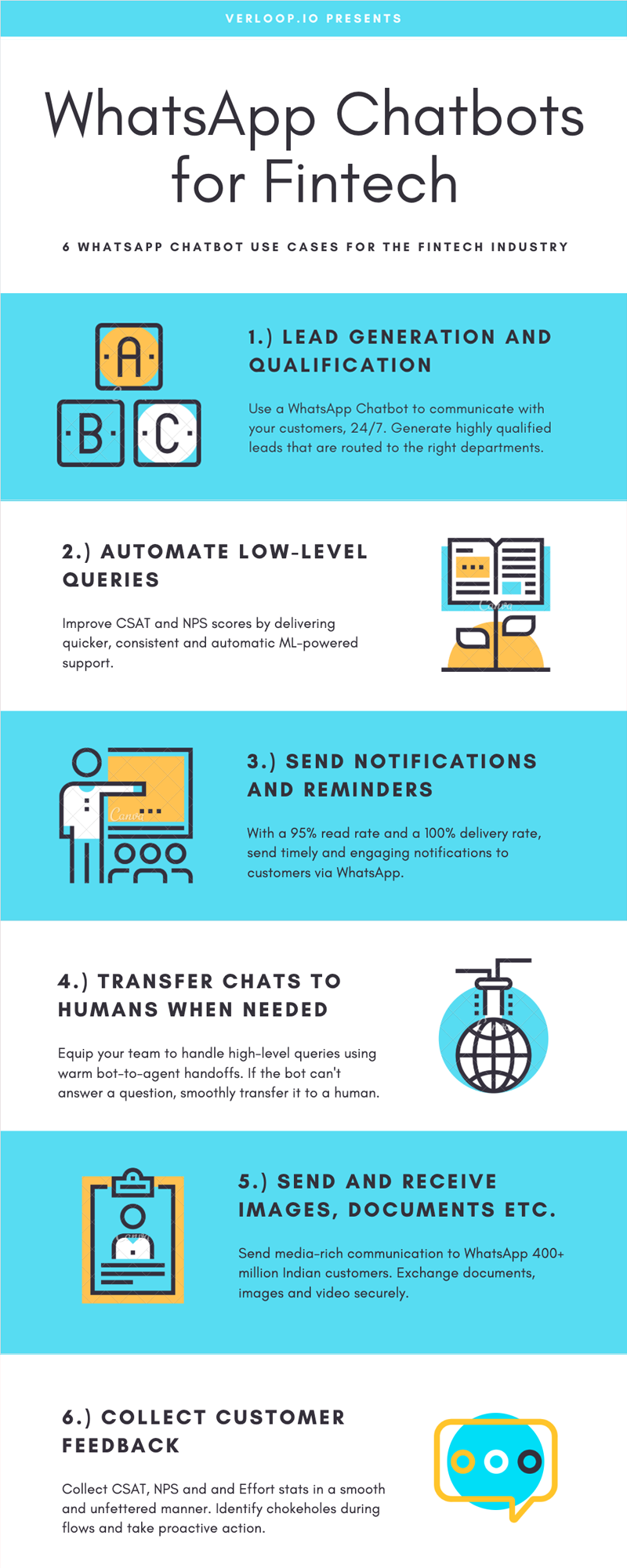

We’ll talk about ten use cases in this blog. (you can suggest more in the comments below)

- Lead Generation

- Lead Qualification

- Answer FAQs

- Share Documents

- Alerts & Notifications

- Check Balance

- High-Level Queries

- Collect Feedback

- Send offers and discounts

Lead generation

The first step to any successful sales funnel is lead generation.

Companies aim to walk the line between generating lots of leads and generating high-quality leads. Using a WhatsApp Chatbot for Fintech, you can do both.

Our hypothetical customer Kevin has just seen a PayQuick ad on his platform of choice.

Using a ‘click-to-chat‘ CTA, Kevin’s directed to PayQuick’s WhatsApp bot where he is greeted with a prewritten message. One tap and he’s off to the races.

A Fintech WhatsApp bot can collect any details you’d like to from. Once a customer has sent you a message, their phone number and name are automatically picked up.

Auto-number collection reduces the questions you need to ask and WhatsApp’s ease of use boosts the form fill rate. Both together means more leads into your funnel.

Lead qualification

Generating lots of leads is only the first step toward a successful sales process.

You now need to ensure that the leads are properly qualified and then handed to the right teams.

Once Kevin has submitted his contact details, he can self-qualify himself by simply continuing the conversation.

Using smart routing leads like Kevin can be sent to the Mutual Funds team. Insurance leads can be sent to the insurance team and so on.

Once qualified, agents no longer have to spend time asking these qualification questions and can instead focus on immediately closing the lead.

FAQs

Depending on the products a fintech company provides, there are several ‘knowledge’ hurdles a customer faces during the purchase process.

Customers buy from companies that answer their questions the quickest.

Suggested Reading: Customer Support Automation and It’s Importance

Instead of transferring customers to 40-page FAQ sections, answer queries on the go using your WhatsApp Chatbot for Fintech.

Using Verloop’s advanced analytics, you can identify the most-asked queries. And incorporate these insights into your purchase process.

Answering questions efficiently ensures that customers proceed through the sales funnel quicker, improving your sales efficiency. And you can do that with an FAQ chatbot.

Upload necessary documents

Document submission is an integral part of the fintech onboarding process.

This could range from a simple single-document submission for KYC, to more complex multi-document procedures. Such as insurance or loan validation.

Fintech companies traditionally see large drop-offs during this step of the sales funnel. Issues like submission, network and/or channel hurdles plague completion rates.

Using a chatbot for WhatsApp Business, you can formalise document submission on the easiest platform known to man.

WhatsApp customers send each other images, videos, and documents every day. It’s an easy, automatic process that puts customers in a position to succeed.

Alerts and notifications

Remind customers about upcoming bills and payments by sending them notifications with WhatsApp Message Templates.

In the following example, we see PayQuick FinTech WhatsApp Chatbot reminding Kevin about a pending electricity bill. Thereby encouraging him to clear it using the PayQuick app.

Traditionally, WhatsApp sees a delivery rate of 100% and an open rate of 97%. This ensures both engagement and awareness. Thus, providing the famously efficiency-focused fintech firms with more bang for their buck.

Businesses can also send notifications to customers in the event of payment failures.

Check balance

Traditional Customer Support systems are cursed by the 80/20 rule.

80% of all support queries come from 20% of a company’s FAQ dataset.

Fintech firms are buried with thousands of easily automated, low-level queries every day. These clog up support resources, increase TAT and reduce the number of tickets closed.

You can assign a bot to automatically answer your most frequently asked queries.

Automate queries related to balance checking and delivery verifications. Or even refund statuses with deep CRM and OMS integrations.

What’s new in fintech: Cryptocurrency, conversational AI, customer support

Higher-level queries

Once you’ve automated 80% of your low-level queries, it’s time to focus on the all-important 20%.

A WhatsApp Chatbot for business can automate low-level queries. But there are certain important issues that need a human hand.

Payments are the crux of all sales hurdles. There is no more sure-fire way to lose a customer. Then to deduct when you shouldn’t have or not provide a refund when you should’ve.

Using warm hand-offs, transfer important chats to specific agents, teams, and departments based on keywords used in the query.

Feedback collection

Understanding how satisfied your customers are is a pivotal part of bettering CX.

According to a study by Moz, a single negative review can lose a company as many as 22% of its customers. Just four such articles can drive off 70 per cent of potential customers.

Tracking customer satisfaction through processes allows you to determine drop-off points and take measures towards improving them.

A WhatsApp Chatbot for Fintech allows you to collect CSAT, NPS and any other metrics you’d like to track in a smooth manner.

Offers and discounts

It is important to note right off the bat – WhatsApp does not allow promotional outbound messages.

However, IF a customer texts you first or replies to an outbound, you can send them offers and discounts.

Why is it the best investment?

- They will run 24/7 and can operate with a minimal level of human interface.

- Through automation, you can maintain consistency with every user.

- An interactive platform to collect all the viable feedback on time allowing to act upon the problem areas.

- Seamless performance during peak hours as well, therefore witnessing a steady response rate.

- End-to-end encryption makes it completely secure and easy to send and receive all security heavy details.

- WhatsApp has seen a 100% deliverability rate and 3x the conversions

Here’s why Verloop.io’s the right fit – Our seamless dashboard allows one to view multiple metrics to track the current functioning of the bot. We can assure you that by using Verloop.io’s WhatsApp Chatbots you will witness a 97% readability rate.