How to Calculate Customer Acquisition Cost (CAC) and Improve It?

How to Calculate Customer Acquisition Cost (CAC) and Improve It?

Customer Acquisition Cost or CAC is the cost of convincing a potential customer to buy a product or a service. This is a key metric to help you determine the value/success of your customer acquisition campaigns. Also known as your marketing campaigns.

If you want to dip your toes into other markets or acquire new customers, it’s important to know what your CAC is. This is to ensure that you’re optimally spending your money to reach a profit.

Marketing specialists usually analyze how to optimize the return on advertising investments. Or how the costs can be reduced.

Thus, Customer Acquisition Cost helps in comparing the amount of money spent on attracting new customers (which is done through running ads, sending an outreach email campaign, etc) vs. the number of customers actually gained.

Calculate Your Customer Acquisition Cost

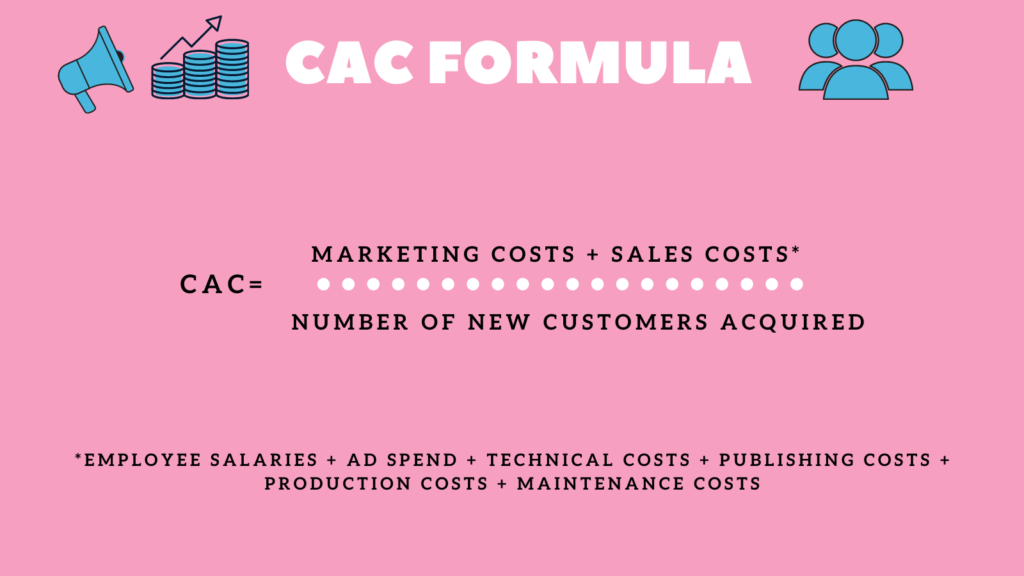

The formula to calculate your Customer Acquisition Cost can change depending on your business model.

Here’s the general formula to calculate the customer acquisition cost:

*To note, this formula works great if your sales cycle is short. But, if your company has a longer sales cycle, i.e. more than 30 days, then this formula won’t work for you. (we’ll cover this later)

These Are the Expenses That’ll Come under Your Sales and Marketing Costs:

- Employee Salaries: Hiring right and investing in great employees is very crucial. And if the costs incurred here are too high, then instead of opting for lay-offs or salary cuts, one can opt for productivity enhancers such as chatbots or automation tools which will help reduce the need for mundane or unnecessary tasks.

- Ad spend: This is the money that you’re investing in running advertisements. It’s important to keep a check on the ads that are run and that they are targeting the correct audience, run for the right duration, etc.

- Technical costs: These costs are incurred from the technology that is used by your sales and marketing teams.

- Publishing costs: This includes the amount spent to publish your company creatives or any ad on any public platform. Such as social media, newspapers, online magazines, etc.

- Production costs: These are the costs affiliated with the material required for creating the content. It could be the cost to purchase a camera to create a video. Or hiring a freelancer to write an article for the company.

- Maintenance costs: You’ll have to invest or spend money on updating/maintaining your products and services. This is the money that helps in enhancing your UX and UI.

EXAMPLE: Let’s say for a month, your company has a total marketing and sales spend of $3,500. This includes:$1,000(employee salaries); $500(investment on advertisement); $250(technical costs); $250(publishing costs); $500(production costs); $1,000(maintenance costs). And your company has generated an additional 100 new customers. Thus CAC becomes $35 ($3500/100)

We can conclude that the cost to acquire a customer for that month would be $35.

For your coming months, you might have an increase in the salary spent or the publishing costs.

Thus, the customer acquisition cost derived for a month will not hold true for the upcoming months.

EXAMPLE: Let’s say your sales cycle is for 2 months. After one month, you plan on increasing your publishing costs and advertising expenditure. It’s decided that both will be increased by $1,000 each. So, you can say that the marketing spend increases by 2k for one month. But since you have a two-month sales cycle, you won’t see a return on that spend till the end of the second month.

And so, calculating your customer acquisition cost for the current month will make no sense.

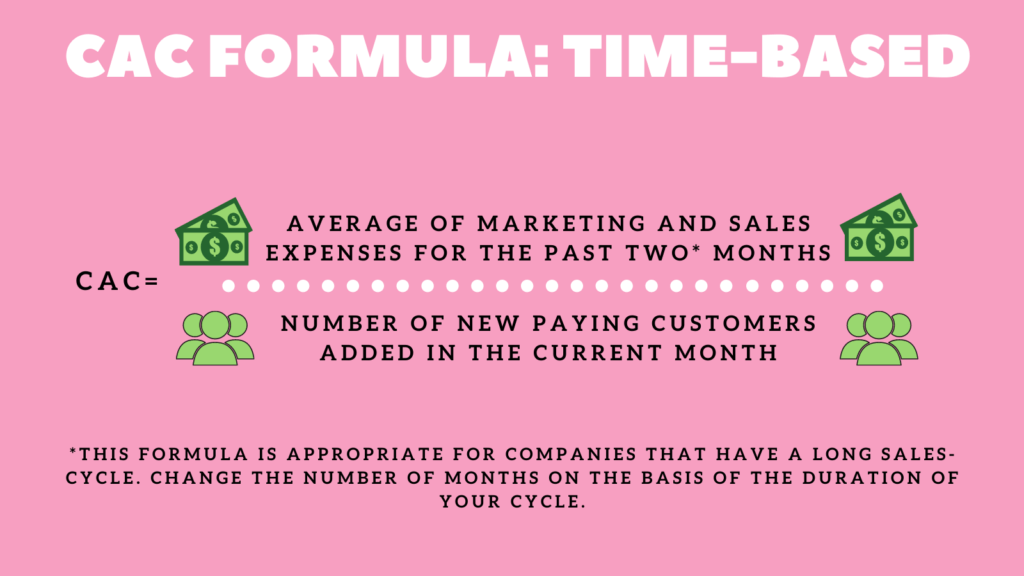

To avoid this, you can improve the current CAC formula and get a much more accurate value by including a new factor, i.e. time.

Find out Your Time-based Customer Acquisition Cost

Again, considering the sales cycle is for two months, this becomes the new formula:

Especially in the months when your expenses are high, this formula will help you get an accurate CAC and help you realize the true value of your customer acquisition strategy.

So, a time-based CAC calculation becomes much more accurate if you have a longer sales cycle. Where time plays an important role.

EXAMPLE: Month 1 - $2,000 (marketing and sales expenses) Month 2 - $2,100 (marketing and sales expenses) Month 3 - 50 (Number of customers acquired in that month) CAC (time-based) becomes; $4,100/2 = $2050 So, $2050/50 = $41 is the CAC.

Customer Acquisition Cost for Marketing Campaigns

This will help you understand which campaigns are running well and which ones you should stop.

EXAMPLE: Let’s say a company decides to start running Google ads along with it’s regular LinkedIn ads. The company sets aside $2,000 for LinkedIn ads and $1,000 for Google ads.

Thus, $3000 (2k+1k) will remain constant until the length of the campaign. Let’s consider 3 months. But, the number of customers acquired will vary on a monthly basis.

Month 1 - 4 customers acquired (LinkedIn); 5 customers acquired (Google)

Month 2 - 5 customers acquired (LinkedIn); 6 customers acquired (Google)

Assuming that they don’t have a long sales cycle, the CAC for the respective ad campaigns will be-

Month 1

LinkedIn - $2,000/4 = $500

Google - $1,000/5 = $200

Month 2

LinkedIn - $2,000/5 = $400

Google - $1,000/6 = $166.6

You will know which campaign is resulting in more value. That is, which helps in acquiring more customers and reduces expenditure. Here, the winner is Google ads.

How Can You Reduce Your CAC?

There are different ways through which you can improve your current customer acquisition cost. Improving your score would mean reducing the acquisition cost and acquiring more customers or providing exceptional customer service to your existing customers. Here’s how you can do that:

Focus on the Correct Market

If you’re able to define your target market better, then the ads that you run will reap more benefits. By studying your target market, and creating a buyer persona you will be able to run appropriate campaigns that’ll acquire more customers.

Move Towards Retargeting Ads

Instead of having a huge proportion of lost users, an easier way to bring back more users into the funnel is through retargeting. If done correctly, this will also help you bring a lot more customers, who seemed disinterested at first. Eg: You can create retargeting ads on Facebook.

Say Yes to Automation

With automation, you can speed up a process that would generally take a couple of hours to finish. A proper automation platform can help you reduce costs and use your resources efficiently. Companies that decide to automate see an increase in revenue within six to nine months. And if your revenue shoots up, it means that you’ll have a lower customer acquisition cost.

Suggested Reading: Customer Support Automation and Its Importance

Watch Out for Customer Churn-rate

A high churn rate shows the number of customers who’ve left you within a given time-frame. In most cases, a high churn rate results due to poor customer experience. As – “89% of consumers have switched to doing business with a competitor following a poor customer experience.” And this will lead to a higher CAC as well, given that the cost to acquire a new customer is more than retaining an existing one. Customer support automation platforms come in handy here and help enhance the entire experience.

Test Your Ad Copy

It’s advised to make versions of your ad copy to check which one works best for you. Compare the copies on the basis of the click-through-rates. And pause the low-performing ads. If your ads work well, then you’ll definitely acquire more customers.

Improve Your Conversion Rate

It’s the number of users who actually convert by completing the desired action such as downloading an ebook, or booking a demo, etc. The conversion rate depends on a number of factors such as the copy of the content, the CTA matching their need, etc. Thus, if these are in line, then the conversion rate will massively increase. Which improves your CAC.

If you want a much more comprehensive read on CAC and how it’s different from Lifetime value and Cost per acquisition, you can read this: Know your Customer Acquisition Cost.